Market Review and Outlook

These are not the opinions or recommendations of Texas Retirement Solutions or Sound Income Strategies LLC, but rather of third party contributors.

Weekly Market Commentary

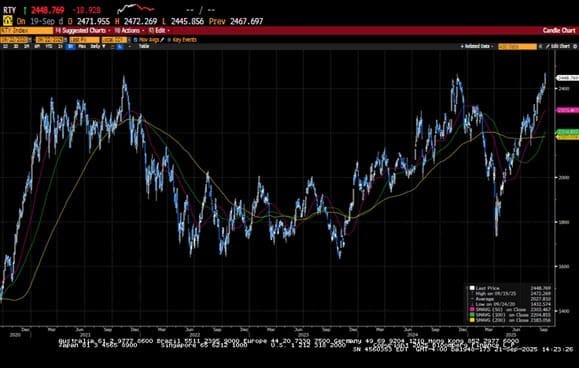

Apprehensive investors pushed markets higher this week, with the small-cap Russell 2000 hitting a new all-time high, while the S&P 500 closed just 50 points below its October all-time high. Economic data, some of which is quite dated, offered a mixed picture of the economy and did little to recalibrate rate-cut expectations for the Fed’s December FOMC meeting next week, which currently stands at an 87.5% probability of a 25 basis-point cut. That said, the market expects material dissent at the meeting, which will likely lead to a hawkish cut and temper expectations for cuts in 2026. President Trump announced he would decide on the next Federal Reserve Chairman in early 2026, while Wall Street pushed back on the proposition of frontrunner Kevin Hassett. Mega-caps outperformed, as did cyclicals such as industrials and financials. Netflix announced it will acquire Warner Bros. Discovery for $72 billion, or $27.75 per share, in a deal to be financed with significant debt. Undoubtedly, the deal will come under antitrust scrutiny, but Netflix agreed to a $5 billion breakup fee, suggesting it will likely make concessions to get the deal across the finish line. BHP walked away from a $52 billion bid for Anglo American as the deal could not get off the ground. Artificial Intelligence continued to make headlines with more deals on the tape, new chip solutions announced, and a Code Red alarm sounded by OpenAI’s Sam Altman related to Google’s Gemini progress. Heightened concerns regarding the circular nature of several AI deals, increased debt financing, valuations, and tempered expectations from some companies around their AI initiatives continue to be prevalent in the headlines. Salesforce.com and MongoDB posted solid earnings and had encouraging outlooks. Snowflake had a solid quarter but tempered expectations around its AI solutions. Dollar General posted a strong quarter as consumers seek value, while Kroger surprised the street by lowering expectations for the coming year. Holiday shopping appears to be off to a good start; however, some have suggested the numbers are impressive not because of increased volume, but because of increases in prices.

The S&P 500 gained 0.3%, the Dow rose by 0.5%, the NASDAQ increased by 0.9%, and the Russell 2000 posted a 0.8% advance. The US Treasury market was under pressure across the curve, posting one of its worst weeks in months. The 2-year yield increased by seven basis points to 3.56%, while the 10-year yield increased by twelve basis points to close the week at 4.14%. Notably, Japan’s 10-year JGB yield continued to rise and hit multi-year highs as the BOJ is poised to increase its policy rate. The perceived policy divergence between the Fed and BOJ has weakened the US Dollar relative to the Yen, with the cross closing at 155.28 on Friday. The US Dollar index closed lower by 0.5% to 99.14. Oil prices regained the $60 level, increasing by $0.63 for the week. Gold prices were little changed, losing $12.20 on the week to close at $4243.50 per ounce. Silver prices increased by 4.3% to $58.88 per ounce. Copper prices rose by $0.19, or 3.6%, to $5.46 per Lb., with some strategists calling for even higher prices. Bitcoin prices started the week lower, then bounced mid-week, only to finish the week lower. The performance divergence in Bitcoin from other risk assets over the last couple of months is interesting, but we remain constructive on the asset. Notably, Vanguard announced this week that it would allow bitcoin on its platform, potentially increasing the demand.

The Fed’s preferred measure of inflation for September came in line with expectations at 0.3% for the headline figure and 0.2% for the core figure, which excludes food and energy. On a year-over-year basis, the headline figure increased by 2.8%, up from 2.7% in the prior month, while the Core figure increased by 2.8%, down from 2.9% seen in August. The takeaway from the report is that inflation remains well above the Fed’s mandate, and while it’s not moving higher right now, it seems sticky and reluctant to move lower. Personal Income and Personal Spending were also in line with expectations at 0.4% and 0.3%, respectively. ISM Manufacturing shrank the most in four months to 48.2% from the prior reading of 48.7%. ISM Services, on the other hand, expanded to 52.6% from 52.4%. ADP private payrolls data came in lower than expected, and while the Challenger job-cut data was better than in October, it still showed significant layoffs in November. We will not receive the BLS Employment Situation Report for another two weeks, so the Fed will have to rely on these private data sources, along with high-frequency claims data. Initial claims fell by a surprising 27k to 191k, while Continuing Claims fell by 4k to 1939k. It was a holiday-shortened week, but it still does not show the labor market falling off a cliff. Finally, the preliminary December University of Michigan Consumer Sentiment index increased to 53.3 from November’s final reading of 51.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

Safe Money Options Heading Into 2026

A Financial Advisor’s Guide to Protecting What You’ve Worked So Hard to Build

When markets are choppy and headlines are loud, many people start asking the same question:

“Where can I put my money so it feels safer, but still has a chance to grow?”

As we move into 2026, that question is more important than ever. Volatile markets, changing interest rates, and lingering inflation concerns have reminded investors that risk and reward always travel together—and that not every dollar should be riding the rollercoaster.

That’s where safe money options come in.

In this article, we’ll walk through what “safe money” really means, why it matters, and several common tools you can explore with a financial professional to help protect your nest egg while still moving toward your long-term goals.

What Do We Mean by “Safe Money”?

“Safe money” doesn’t mean “no risk at all.”

Instead, it generally refers to assets that prioritize:

Preservation of principal (protecting your original investment)

Lower volatility (less dramatic ups and downs)

Predictability (more stable and understandable outcomes)

Safe money options are often used for:

Short- to medium-term goals

Emergency or opportunity funds

The “sleep at night” portion of a retirement plan

Income planning in retirement

Think of safe money as the foundation of a financial house. It’s not always the most exciting piece, but it helps everything else stand strong.

Why Safe Money Matters More as You Approach Retirement

The closer you are to retirement—or already in it—the less time you have to recover from big market declines.

Two big risks come into play:

Sequence of returns risk

Experiencing a major market downturn early in retirement can have a much larger impact on your long-term income than the same decline later on, especially if you’re withdrawing money at the same time.Emotional risk

When portfolios drop sharply, many people are tempted to sell at the wrong time or abandon their long-term plans—often locking in losses.

Safe money strategies can help:

Provide stable income streams

Give you cash reserves so you’re not forced to sell investments in a down market

Make it emotionally easier to stay invested with your growth-oriented dollars

Common Safe Money Options to Consider for 2026

Important: The right mix depends on your goals, time horizon, and risk tolerance. Always review options with a qualified financial professional before moving money.

1. High-Yield Savings and Money Market Accounts

For truly short-term needs—emergency funds, near-term purchases, or “parking” cash—high-yield savings accounts and money market deposit accounts at banks or credit unions can be attractive.

Pros:

Easy access to your money

FDIC- or NCUA-insured up to applicable limits when held at insured institutions

Variable interest rates that may adjust with the rate environment

Cons:

Interest rates can move up or down

Typically not designed as long-term growth vehicles

Returns may or may not outpace inflation over time

These are often best for liquidity and safety, not long-term wealth building.

2. Certificates of Deposit (CDs)

Certificates of deposit (CDs) are time deposits offered by banks and credit unions. You agree to leave your money on deposit for a set period (e.g., 6 months, 1 year, 3 years) in exchange for a fixed interest rate.

Pros:

Generally predictable, fixed interest rate for the term

FDIC/NCUA insurance up to the applicable limits at insured institutions

Can be “laddered” (staggering maturities) to balance access and yield

Cons:

Early withdrawals often come with penalties

Your money is locked up for the term unless you pay a fee

If interest rates move up later, older CDs may look less attractive

CDs can work well for money you know you won’t need for a specific period and want a guaranteed rate from a bank or credit union.

3. Fixed Annuities

Fixed annuities are contracts issued by insurance companies that can provide a guaranteed interest rate for a period of time, and in some cases, options for lifetime income later.

Pros:

Principal protection and a contractual interest rate when held to term, backed by the claims-paying ability of the issuing insurance company

May offer higher yields than many traditional bank products, depending on the interest rate environment

Can be structured to provide a predictable income stream in retirement

Cons:

Not FDIC-insured

Surrender charges may apply if you withdraw more than allowed during the surrender period

Terms, riders, and fees vary widely—these are complex contracts that require careful review

Fixed annuities can serve as a bridge between ultra-conservative options and market investments, especially for people looking for guaranteed interest or income over a set period.

4. Fixed Indexed Annuities

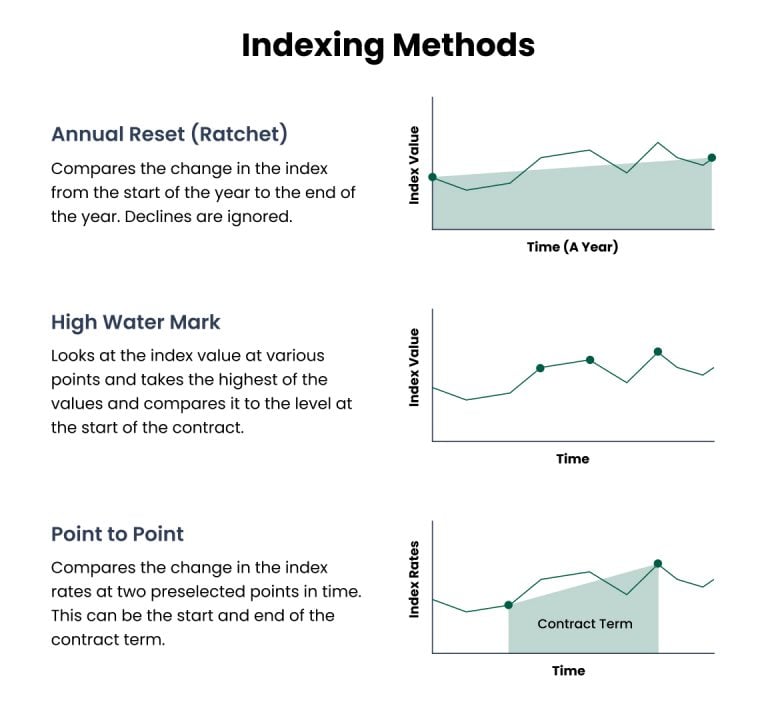

Fixed indexed annuities (FIAs) are another insurance-based option. They typically offer:

Principal protection (no direct market loss when held under contract terms)

Growth potential tied to an index (such as the S&P 500®) using formulas, caps, participation rates, and/or spreads

The trade-off is that your upside is limited by the contract’s terms.

Pros:

Protection from market downturns, again backed by the issuing insurer’s claims-paying ability

Growth potential that may be higher than traditional fixed rates

Some contracts offer income riders for predictable retirement income

Cons:

More complex than CDs or simple fixed annuities

Growth is subject to caps, spreads, or participation rates—you don’t receive the full market return

Surrender periods and fees can be significant

FIAs are often used as part of a broader retirement income strategy for clients who want some growth potential without direct market losses, but they should be thoroughly explained and understood.

5. Short-Term Bonds and Conservative Bond Funds

Short-term, high-quality bonds and conservative bond funds can also play a role in the safer side of a portfolio.

Pros:

Can provide a stream of interest income

Shorter durations may reduce interest rate sensitivity compared to long-term bonds

Can diversify a portfolio away from stocks

Cons:

Not guaranteed—bond values can go up or down

Subject to interest rate risk, credit risk, and inflation risk

Bond funds don’t have a fixed maturity date like individual bonds

These can make sense inside a diversified portfolio, especially when managed as part of an overall investment strategy rather than a standalone “safe” bucket.

Building a “Safe Money Bucket” Strategy

Instead of trying to find one magic product, think in terms of buckets:

Short-Term Bucket (0–2 years)

Goal: Liquidity and stability

Tools often used: High-yield savings, money market accounts, short-term CDs

Income & Stability Bucket (2–10 years)

Goal: Predictable income and principal protection

Tools often used: Fixed annuities, fixed indexed annuities, CD ladders, short-term bonds

Growth Bucket (10+ years)

Goal: Long-term growth to outpace inflation

Tools often used: Diversified stock portfolios, ETFs, growth-oriented investments

Safe money options typically live in the first two buckets, supporting your lifestyle and income needs so your long-term, growth-oriented investments have time to ride out market cycles.

Key Questions to Ask Your Financial Advisor

As you prepare for 2026 and beyond, here are some smart questions to bring to a conversation:

How much of my overall portfolio should be in safe money options based on my age, goals, and risk tolerance?

What are the pros and cons of the safe money tools you’re recommending?

Are there any fees, surrender periods, or penalties I should know about?

How will this safe money strategy support my retirement income plan?

How does this fit with my other investments, Social Security, pensions, or other income sources?

The Bottom Line: Safety With a Purpose

Safe money isn’t about hiding from the market forever. It’s about having a strategy so that:

You can weather market downturns without panicking

Your essential expenses and near-term goals are protected

You still have a path for long-term growth and opportunity

Heading into 2026, the investors who feel the most confident aren’t the ones trying to guess the next big market move. They’re the ones who have a balanced plan—with both growth and safety built in.

If you’re unsure whether your current strategy gives you the right amount of protection, now is a great time to sit down with a financial professional, review your options, and make sure your money is working for you safely and strategically.

Stretch RMDs and Roth Conversions: Today’s Slott Report Mailbag

By Ian Berger, JD

IRA Analyst

Question:

Hello Ed,

I have been a fan of yours for a long time (and the owner of a copy of The Retirement Savings Time Bomb) and have always appreciated your insights.

We have a client who is age 58 years and is the sole beneficiary of a traditional IRA of a non-spouse relative (sister) who died at age 51 in 2022. The client is therefore an eligible designated beneficiary (EDB) because she is not more than 10 years younger than the deceased, So, she can choose to stretch required minimum distributions (RMDs) over her lifetime based on the Single Life Table.

My assumption is that our client must begin taking RMDs in the year following the year of death (and not wait until she attains age 73), but I am unable to confirm this. Also, due to the fact that the IRS waived RMDs for IRAs inherited between 2020 and 2023, can she begin taking stretch RMDs in 2025 using the factor for her age in 2023 (minus 2.0)?

I appreciate your help.

Michael

Answer:

Hi Michael,

Thank you for the kind words! Your assumption that your client should have started taking annual RMDs in 2023 is correct. Only spouse beneficiaries who roll over an inherited IRA to their own IRA can delay RMDs until age 73. Further, the IRS waiver you mentioned only covers non-spouse beneficiaries subject to the 10-year payment rule who are required to take annual RMDs. It does not cover EDBs subject to the stretch like your client. So, your client has missed RMDs for 2023 and 2024 and should request a penalty waiver using IRS Form 5329. Alternatively, your client could choose to be governed by the 10-year rule. In that case, there would be no annual RMDs, but the entire inherited IRA would need to be emptied by 12/31/32.

Question:

I have a significant amount of money in an IRA. My son keeps bugging me to roll over some each year to a Roth IRA. Can I do this if I am retired and have no job and no earned income.

Thanks,

Ray

Answer:

Hi Ray,

Yes. You can do a Roth conversion in any year regardless of what your compensation is and even if you have no compensation. The rule is different for traditional IRA or Roth IRA contributions, where you need compensation up to the amount of your contribution.

If you have technical questions you would like to have answered, be sure to submit them to mailbag@irahelp.com, to be answered on an upcoming Slott Report Mailbag, published every Thursday.

https://irahelp.com/stretch-rmds-and-roth-conversions-todays-slott-report-mailbag/

The Crazy-Complicated 2026 SIMPLE IRA Plan Elective Deferral Limits

Ian Berger, JD

IRA Analyst

Since 2002, SIMPLE IRA plans have allowed employees who reach age 50 or older by the end of the year to make “catch-up contributions” beyond the usual elective deferral limit.

Beginning in 2024, Congress automatically increased the regular and catch-up contribution limits for smaller (25 employees or fewer) SIMPLE IRA plans. These higher deferral limits were intended to make small-business retirement benefits more competitive with the benefits offered by larger employers. The same higher limits were also available for larger (26-100 employees) plans, but only if the employer makes a higher-than-usual company contribution. (If the employer matches deferrals, the match must go up to 4% of pay instead of the usual 3% of pay. If the employer contributes to all eligible employees, the contribution must go up to 3% of pay instead of the usual 2%.)

Starting in 2025, Congress raised the catch-up limit even higher for participants aged 60-63 by allowing “super catch-up contributions” to SIMPLE IRA plans.

Although well-intentioned, these changes have caused the SIMPLE IRA plan deferral limits to become far too complicated. Depending on your age, the size of your company and (in the case of larger businesses), the amount of your company’s contribution, you are subject to one of six SIMPLE IRA deferral limits, including one of three catch-up limits. On November 13, 2025, the IRS announced the 2026 COLA limits for IRAs and retirement plans. Here are the 2026 limits for SIMPLE IRAs:

- If you’re under age 50 on December 31, 2026, and your company has 25 or fewer employees, your deferral limit is $18,100. The same limit applies if you’re under age 50 on December 31, 2026, your company has more than 25 employees, and it makes the increased company contribution.

- If you’re under age 50 on December 31, 2026, your company has more than 25 employees, and it doesn’t make the increased company contribution, your deferral limit is $17,000.

- If you’re between ages 50 and 59 OR age 64 or older on December 31, 2026, and your company has 25 or fewer employees, your total deferral limit is $21,950 (including $18,100 of regular deferrals and $3,850 of catch-ups). The same limits apply if you’re between ages 50 and 59 OR age 64 or older on December 31, 2026, your company has more than 25 employees, and it makes the higher-than-usual company contribution.

- If you’re between ages 50 and 59 OR age 64 or older on December 31, 2026, your company has more than 25 employees and it doesn’t make the increased company contribution, your total deferral maximum is $21,000 (including $17,000 of regular deferrals and $4,000 of catch-ups).

You will notice that the 2026 age-50-and-older catch-up limit for smaller employers (and larger employers who make the higher company contribution) – $3,850 – is lower than the $4,000 age-50-and-older catch-up limit for other larger employers. This was clearly not intended by Congress and results from a quirk in the tax code as to how COLAs are applied to various deferral limits. Hopefully, Congress will fix this for future years.

- If you’re between ages 60 and 63 on December 31, 2026 and your plan allows it, you can defer up to a total of either $23,350 or $22,250 (including regular deferrals up to $18,100 or $17,000,and $5,250 of super catch-ups).

If you have technical questions you would like to have answered, be sure to submit them to mailbag@irahelp.com, to be answered on an upcoming Slott Report Mailbag, published every Thursday.

https://irahelp.com/the-crazy-complicated-2026-simple-ira-plan-elective-deferral-limits/

Who Needs to Take a 2025 RMD?

By Sarah Brenner, JD

Director of Retirement Education

As the calendar runs out on 2025, retirement account owners and beneficiaries may face a looming deadline. December 31 is the deadline for many to take 2025 required minimum distributions (RMDs). Test your knowledge of RMDs with our quiz. Who needs to take a 2025 RMD by December 31, 2025? Answers can be found below the quiz.

- Rick just celebrated his 73rd birthday on November 21. He has a traditional IRA. Does Rick need to take a 2025 RMD by December 31?

- Kate, age 75, is still working for a company that offers a SIMPLE IRA plan. Does Kate need to take a 2025 RMD by December 31?

- Luis, age 54, inherited a traditional IRA from his father who died at age 90 in 2024. Luis is subject to the 10-year payout rule. Does Luis need to take a 2025 RMD by December 31, 2025?

- Luis also inherited Roth IRA from his father and is subject to the 10-year payout rule. Does Luis need to take a 2025 RMD by December 31, 2025?

- Janice, age 54, died in 2018. Her sister, Carol, age 49, inherited her traditional IRA. Carol died in 2024. Her daughter, Madi, is the successor beneficiary of this inherited IRA. Does Madi need to take a 2025 RMD by December 31, 2025?

Answers

- NO. Rick does not need to take his 2025 RMD by December 31. Because this is the year that Rick reaches age 73, it is the first year for which he must take an RMD. The deadline for taking the first RMD is April 1 of the following year, so Rick does not need to take his 2025 RMD until April 1, 2026.

- YES. Because Kate is age 75 in 2025, she must take an RMD from her SIMPLE IRA. It does not matter that she is still working for the company that offers the SIMPLE IRA plan. The still-working exception only applies to employer plans that are not IRA based. It does not apply to SIMPLE IRAs, so Kate must take a 2025 RMD by December 31, 2025.

- YES. In final regulations, the IRS confirmed that if the IRA owner dies after their required beginning date (April 1 of the year following the year age 73 is reached) then annual RMDs must be taken by the beneficiary during the 10-year payout period. Due to confusion over this rule the IRS waived the requirement for 2021, 2022, 2023, and 2024. However, these RMDs are required for 2025. Luis will need to take his RMD by December 31, 2025.

- NO. Roth IRA owners are never required to take RMDs during their lifetime, so all Roth IRA owners are considered to have died before their required beginning date. Therefore, no RMDs are required during the 10-year payout period for Roth IRA beneficiaries. Luis will not have to take a 2025 RMD from the inherited Roth IRA by December 31, 2025.

- YES. Madi as a successor beneficiary is subject to the 10-year rule. She also must take an RMD for 2025. The IRS confirmed in final regulations that because annual RMDs started when the account was inherited by Carol (before the SECURE Act, when all designated beneficiaries could take stretch RMDs), those distributions must continue for the successor beneficiary. Therefore, Madi must take a 2025 RMD by December 31, 2025.

If you have technical questions you would like to have answered, be sure to submit them to mailbag@irahelp.com, to be answered on an upcoming Slott Report Mailbag, published every Thursday.

https://irahelp.com/who-needs-to-take-a-2025-rmd/

Weekly Market Commentary

The holiday-shortened week saw global financial markets trade higher. Increased optimism for a December rate cut, along with some constructive news on the AI front, catalyzed buying across risk assets. Several Fed officials indicated they were inclined to support a December rate cut, which pushed the probability of a cut to over 80%. Of note, Kevin Hassett, the National Economic Council Director, has apparently become the frontrunner for President Trump’s choice for Fed Chairman. The Philadelphia Semiconductor index gained 9.7% on the week, even as Nvidia struggled after the news that Meta is considering Google’s rival chip as an alternative to Nvidia’s GPU solutions. Intel soared by more than 10% on news that Apple may source Intel chips. Dell posted solid earnings, boosting the artificial intelligence trade.

The S&P 500 regained its 50-day moving average, gaining 3.7% for the week, 0.13% for the month of November, and is up 17.79% year to date. The Dow added 3.2%, the NASDAQ increased by 4.9% but still ended the month with a 1.5% loss, and the Russell 2000 jumped 5.5% on the week. The Healthcare sector led the market in November, rising by 9.1% over the month. US Treasuries end the week higher across the curve despite weak auctions of 2-year, 5-year, and 7-year notes. The 2-year yield fell by two basis points to 3.49%, while the 10-year yield fell by four basis points to 4.02%. Oil prices advanced by $1.38 or 2.4% despite what appeared to be constructive negotiations to end the war between Russia and Ukraine. West Texas Intermediate crude closed at $59.44 a barrel. Gold prices moved sharply higher, gaining 4.3% on the week, closing at $4255.70 per ounce. Silver prices went to new all-time highs, increasing by 13% on the week and closing at $56.45 per ounce. Copper prices also had a nice week, gaining 4.98% to close at $5.27 per Lb. Bitcoin prices bounced off the recent sell-off, advancing 8.3% to $90,850. The US Dollar index fell by 0.7% to close at 99.47.

The economic calendar was a little lighter than expected, with September PCE, Personal Spending, Personal Income, and the 2nd look at 3rd-quarter GDP growth delayed further. The September reading of the Producer Price Index came in line with estimates at 0.3%, while the Core figure came in at 0.1% versus the estimated 0.3%. Retail Sales for September were a bit light on the headline figure, which came in at 0.2% versus the expectation of a 0.3% gain. The Ex-Autos figure increased by 0.3% versus the consensus estimate of 0.1%. It did appear that the consumer held back on buying goods in September. However, this data is quite old, and readings of Black Friday spending activity suggest that the consumer is still out spending and very resultant. Consumer Confidence came in well below the prior figure at 88.7. The expectations index fell as sentiment about business conditions, the labor market, and household income fell. ADP private payroll data showed a 4-week average drop of 13,500 payrolls. However, Initial Claims fell by 6k to 216k, as Continuing Claims increased by 7k to 1960k.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

The Slott Report Gives Thanks

By Andy Ives, CFP®, AIF®

IRA Analyst

Thanksgiving Season is upon us! Here at The Slott Report, we are thankful for many things:

- We are thankful to have a platform to share all the important IRA and retirement account information about which we write.

- We are thankful that we have an audience of diligent Slott Report readers who are continuously searching for the correct answers to their IRA and retirement plan issues.

- We are thankful that this group of diligent readers also takes the time to send us real-world inquiries for our weekly “Mailbag.” Keep the good questions coming!

- We are thankful that artificial intelligence still fails miserably when trying to answer such detailed retirement questions. (The machines have some work to do before they can replace us.)

- We are thankful that accurate information about the benefits of Roth conversions and net unrealized appreciation (NUA) seems to be traveling well. It is important that everyone is aware of tax-saving strategies like these. Knowledge is power.

- We are thankful for the members of Ed Slott’s Elite IRA Advisor Group℠ who make it their business every day to stay current with all the crazy retirement account rules and properly educate and assist their clients.

- We are thankful for each other, for without the help and teamwork of the entire Ed Slott staff, this website, the programs we offer, the webinars we host, the newsletters we write and the educational conferences we operate would not exist.

Happy Thanksgiving from the entire Ed Slott team!

If you have technical questions you would like to have answered, be sure to submit them to mailbag@irahelp.com, to be answered on an upcoming Slott Report Mailbag, published every Thursday.

https://irahelp.com/the-slott-report-gives-thanks/

Retirement Income Planning Going Into 2026: Turning Your Savings Into a Lifetime Paycheck

For most people, retirement isn’t about a specific age or account balance—it’s about confidence.

Confidence that the bills will be paid, that you can handle surprises, and that you won’t run out of money before you run out of life.

As we approach 2026, retirement income planning is less about chasing big investment returns and more about building a stable, flexible income strategy. The rules around taxes, Social Security, and retirement accounts continue to evolve, and the cost of living is still a major concern for retirees. The good news: with thoughtful planning, you can turn uncertainty into a clear, step-by-step plan.

Let’s walk through the key pieces.

1. Start With Your “Retirement Paycheck” Number

Before you focus on investments, you need to know: How much income do you actually need each month?

Break it down into three buckets:

Must-Have Expenses

Housing (mortgage or rent, taxes, insurance, maintenance)

Groceries and household needs

Utilities and transportation

Basic healthcare costs, premiums, and prescriptions

Want-To-Have Expenses

Travel and vacations

Hobbies, dining out, and entertainment

Gifts and family support

Would-Be-Nice Extras

Major remodels, big trips, new car

Legacy goals: helping grandkids with college, charitable giving

This isn’t just budgeting—it’s prioritizing. In a down market, you may trim “would-be-nice” items while keeping your must-haves fully covered.

2. Map Out Your Income Sources

Most retirees don’t rely on a single source of income. List everything that will contribute to your retirement paycheck:

Social Security benefits

Pensions, if available

Employer retirement plans (401(k), 403(b), 457, etc.)

IRAs and Roth IRAs

Taxable brokerage accounts

Annuities or lifetime income products

Rental properties or business income

Cash savings and CDs

The goal is to see three things:

Guaranteed income (Social Security, pensions, annuities)

Flexible income (investment accounts you can control)

Backup reserves (cash, home equity, etc.)

From there, you can build a strategy: which dollars should you spend first, which should you let grow, and how do you replace your working-years paycheck with a coordinated plan rather than random withdrawals.

3. Understand the New Retirement Rules & RMDs

Tax laws continue to shape how you should draw income. Recent law changes (like the SECURE Act and SECURE 2.0) adjusted the age for Required Minimum Distributions (RMDs) from retirement accounts and changed how inherited accounts are treated. These rules affect:

When you must start taking money from traditional IRAs and 401(k)s

How much taxable income will you report each year

The best timing for Roth conversions or Social Security benefits

Even if you’re not at RMD age yet, planning now for those future withdrawals can help you:

Smooth out your lifetime tax bill

Avoid “tax shock” later when RMDs suddenly push you into a higher bracket

Coordinate your income with Medicare premiums, which are also tied to income levels

This is one area where up-to-date guidance really matters, because a rule that was true five years ago might be different today.

4. Building a “Bucket Strategy” for More Predictable Income

Instead of thinking about one big pile of money, many retirees find it helpful to divide their savings into time-based buckets:

Short-Term Bucket (Years 1–3)

Goal: Stability and liquidity

Investments: Cash, money markets, short-term CDs, very conservative funds

This is your “sleep at night” money for covering your near-term expenses.

Mid-Term Bucket (Years 4–10)

Goal: Moderate growth with some risk

Investments: Balanced portfolios, income funds, dividend stocks, conservative bonds

This helps keep up with inflation while still managing volatility.

Long-Term Bucket (10+ Years)

Goal: Growth for the later years of retirement

Investments: More growth-oriented mix depending on your risk tolerance

This bucket helps protect you from the risk of outliving your money.

This type of approach can keep you from having to sell long-term investments when the market is down, because your near-term income is coming from safer buckets.

5. Protecting Against Inflation

One of the biggest threats to retiree income is inflation—the gradual increase in prices over time. Even modest inflation can quietly cut your purchasing power over a 20- to 30-year retirement.

Ways to prepare:

Include investments with growth potential, not just fixed income

Consider delaying Social Security, if appropriate, since your benefit grows for each year you delay up to age 70

Use a realistic inflation assumption in your plan, not just “today’s prices”

Review your plan regularly to see if your withdrawals are keeping pace with rising costs

The key is balance: you want enough safety to feel comfortable today, and enough growth to keep you comfortable tomorrow.

6. Taxes: Don’t Just Ask “How Much?” Ask “From Where?”

Two retirees with the same total income can pay very different amounts in taxes depending on where their income comes from.

Common account types:

Tax-deferred: Traditional IRAs, 401(k)s

Taxed as ordinary income when you withdraw

Tax-free (if rules are followed): Roth IRAs, Roth 401(k)s

No income tax on qualified withdrawals

Taxable accounts: Brokerage accounts

Interest, dividends, and capital gains may be taxed each year

Smart retirement income planning looks at:

Which accounts to tap first, later, or last

Whether Roth conversions make sense in lower-income years

How to control your tax bracket and potentially reduce lifetime taxes, not just this year’s taxes

Done well, tax-aware income planning can help your money last longer without requiring you to save another dollar.

7. Healthcare, Medicare, and Long-Term Care Costs

Healthcare is often one of the largest expenses in retirement. Even with Medicare, there are premiums, deductibles, co-pays, and services Medicare doesn’t fully cover.

As you plan income going into 2026 and beyond, think about:

Medicare premiums and supplements

Prescription drug costs

Possible long-term care needs (home care, assisted living, nursing care)

Some people choose to build a separate “healthcare bucket” or use insurance solutions to help manage this risk. The important thing is not to ignore it—because it rarely gets cheaper over time.

8. Making Your Income Plan Personal

There is no “one-size-fits-all” retirement income formula. Your plan should reflect:

Your age and health

Whether you’re single, married, or supporting others

How much guaranteed income you have vs. market-based income

How comfortable you are with market ups and downs

Your goals: staying in your current home, traveling, giving, or leaving a legacy

Some retirees want maximum safety and predictability. Others are comfortable with more market exposure as long as they have a basic safety net. A good plan respects both the math and your emotions.

9. Checkpoints Going Into 2026

Before or during 2026, it’s wise to give your retirement income plan a “check-up.” Ask:

Is my monthly income still covering my lifestyle comfortably?

Has my cost of living changed? (housing, healthcare, family needs)

Do my investments still match my risk comfort level?

Have any tax laws, RMD ages, or Social Security strategies changed that affect me?

Do I have a written plan or just a collection of accounts?

If you don’t have clear answers to those questions, that’s your cue to revisit or build a more structured plan.

10. You Don’t Have To Figure This Out Alone

Retirement income planning can feel overwhelming because it touches so many moving parts: investments, taxes, Social Security, Medicare, market risk, and longevity. But you don’t have to solve it alone.

A qualified financial professional can help you:

Map out your income sources and spending needs

Build a diversified strategy for stable income and long-term growth

Coordinate your withdrawals with taxes and healthcare costs

Adjust your plan as life, markets, and rules change

Final Thought

As we move into 2026, the people who feel most confident about retirement aren’t the ones who simply saved “the most.” They’re the ones who have a clear, flexible income plan—one that turns their savings into a reliable paycheck and adapts as life unfolds.

If you haven’t put that kind of plan in writing yet, now is the perfect time to start. Your future self will be very glad you did.

IRA and Retirement Plan Dollar Limits Increased for 2026

By Ian Berger, JD

IRA Analyst

The IRS has released the cost-of-living adjustments (COLAs) for retirement accounts for 2026, and many of the dollar limits will increase next year.

Retirement Plans

The elective deferral limit for employees who participate in 401(k), 403(b) and 457(b) plans is increased to $24,500, up from $23,500. The catch-up contribution limit for those age 50 or over jumps to $8,000, increased from $7,500. The “super catch-up” limit for individuals aged 60, 61, 62 and 63 remains $11,250.

Starting in 2026, certain high-paid participants in 401(k), 403(b) and governmental 457(b) plans who wish to make catch-up contributions must make them to Roth accounts within the plan. This requirement will apply to employees who had 2025 W-2 (Box 3) wages with the current employer that exceeded $150,000.

SEP and SIMPLE IRA Plans

The maximum SEP contribution will increase to $72,000 from $70,000. The cap on compensation that can be taken into account for calculating SEP and other retirement plan contributions moves up to $360,000 from $350,000.

The SIMPLE elective deferral limit is increased as well, going to $17,000, up from $16,500. Individuals in certain SIMPLE plans, including those sponsored by businesses with 25 or fewer employees, can contribute a higher amount. For 2026, this higher amount is $18,100, increased from $17,600.

The general catch-up contribution limit that applies for SIMPLE plan participants aged 50 and over jumps to $4,000, up from $3,500. However, those aged 50 and over who participate in certain SIMPLE plans, including those sponsored by businesses with 25 or fewer employees, are limited to $3,850, the same amount in effect for 2025. (This appears to be a quirk in the law that may need to be fixed by Congress.) The “super catch-up” limit for SIMPLE participants aged 60, 61, 62 and 63 remains $5,250.

IRA Contributions

The IRA contribution limit increases to $7,500, increased from $7,000. The IRA catch-up contribution limit is now indexed for inflation. For the first time, that limit is increased, jumping to $1,100, from $1,000. This will allow those who are aged 50 or over to contribute $8,600 to an IRA for 2026, up from $8,000.

The phase-out range for savers making contributions to a Roth IRA is increased to $153,000-$168,000 for single filers, up from $150,000-$165,000. For those who are married filing jointly, the income phase-out range is increased to $242,000-$252,000, up from $236,000-$246,000.

Phaseout ranges for active participants in employer plans looking to make deductible traditional IRA contributions have also been increased. For single individuals covered by an employer retirement plan, the phase-out range is $81,000-$91,000 for 2026, up from $79,000-$89,000. For married couples filing jointly, if the spouse making the IRA contribution is covered by an employer retirement plan, the phase-out range is increased to $129,000-$149,000, up from $126,000-$146,000. For those who are not covered by an employer retirement plan but who are married to someone who is covered, the phase-out range goes up to $242,000-$252,000, increased from $236,000-$246,000.

Qualified Charitable Distributions

The 2026 limit for qualified charitable distributions (QCDs) is increased to $111,000, up from $108,000 in 2025. And, the limit for a one-time QCD from an IRA to a split-interest entity goes up to $55,000, up from $54,000.

More details on the COLAs for 2026 can be found in IRS Notice 2025-67.

If you have technical questions you would like to have answered, be sure to submit them to mailbag@irahelp.com, to be answered on an upcoming Slott Report Mailbag, published every Thursday.

https://irahelp.com/ira-and-retirement-plan-dollar-limits-increased-for-2026/

Weekly Market Commentary

Financial markets continued to decline as investors sold AI-related stocks amid valuation concerns, while rotating into more defensive sectors such as healthcare and consumer staples. A stellar third-quarter earnings report from NVidia prompted investors to step in and buy the market, but a subsequent reversal lower raised concern about the market’s health. NVIDIA reported year-over-year revenue growth of 62% to $57 billion, while EPS of $1.30 beat the consensus estimate of $1.26. The company issued Q4 guidance above consensus and announced an additional $60 billion share repurchase authorization. Retailers Walmart and Lowes reported better-than-expected results, while Home Depot fell after it missed consensus earnings per share and lowered FY 2026 guidance.

The S&P 500 traded 2% lower and fell further below its 50-day moving average. The Dow gave up 1.9%, the NASDAQ shed 2.7%, and the Russell 2000 lost 0.8%. There were gains across the entire US yield curve as a dovish tone from New York Fed President Williams recalibrated the probability of a December rate cut to 71% from the prior day’s 39%. The FOMC minutes from October showed a divided Fed related to the next policy move. However, there seemed to be a consensus on proceeding with caution, given the uncertain environment. The markets will receive a deluge of economic data this week, which will likely dictate the Fed’s December monetary policy decision. The 2-year yield declined by ten basis points to 3.51%, while the 10-year yield fell by nine basis points to 4.06%. The government will sell 2-year notes on Monday, 5-year notes on Tuesday, and 7-year notes on Wednesday. Oil prices fell by 3.36% or $2.02 to close the week at $58.06 a barrel. Gold prices fell by $15.09 to $4,079.20 per ounce. Copper prices closed the week lower by four cents to $5.02 per Lb. Bitcoin’s price plunged by 9.3% or ~$9,000 to $86,600, amid speculation of forced selling. The US Dollar index rose by 0.9% to 100.15.

Wall Street received its first dose of government-related labor data since the government shut down. BLS data showed that 119k Non-Farm Payrolls were created in September, well above the 50k consensus estimate. Similarly, Private Payrolls increased by 97k versus the estimated 58k. That said, August figures were revised lower for both data sets. The Unemployment rate ticked higher to 4.3%, above the consensus estimate of 4.2%, while Average Hourly earnings fell to 0.2% from 0.3% in August. The Average Workweek figure also fell from the prior month to 34.2 hours. This data is quite old and backward-looking. The BLS announced that the October and November Employment Situation Report would be released on December 16th after the Federal Reserve’s December meeting. This in itself makes the upcoming data deluge even more meaningful to the Fed’s monetary policy decision. Initial Claims for the week ending 11/15 decreased by 8k to 220k, while Continuing Claims for the week ending 11/8 increased by 28k to 1.974- the highest level since November of 2021. The final reading for November’s University of Michigan’s Consumer Sentiment fell to 51 from October’s reading of 53.6 on concerns over higher prices and weakening incomes. Finally, the S&P Global Manufacturing PMI came in at 51.9, down from the prior figure of 52.5, while the Services PMI came in at 55, above the prior month’s reading of 54.8. In the coming week, we will receive the Producer Price Index and Retail Sales. Durable Goods, Jobless Claims, the second estimate of Q3 GDP, September’s PCE, Personal Spending, and Personal Income.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

Estate Planning & You: Getting Ready for 2026 (Without Freaking Out)

state planning sounds like something for billionaires in marble mansions… not for regular people with a mortgage, a 401(k), a dog, and a favorite taco spot.

But here’s the truth:

If you love someone or own something, you need some kind of estate plan.

As we head toward 2026, there’s more buzz than ever around taxes, changing laws, and “what happens if…?” So let’s break this down in plain English — with as little legalese as possible.

What Is Estate Planning, Really?

Think of estate planning as your “instructions folder” for life, money, and family.

It answers questions like:

Who gets what when I’m gone?

Who’s in charge of making it happen?

Who can make medical or financial decisions for me if I can’t?

How can I make things easier, not harder, for the people I love?

Estate planning isn’t just a Will — it’s usually a small toolkit that might include:

Will – Who gets what, and who’s in charge (your executor).

Trust – A way to organize and protect assets, avoid probate, and sometimes reduce taxes.

Powers of Attorney – Who can make financial or legal decisions if you’re unable to.

Healthcare directives – Who can speak with doctors, and what kind of care you’d want.

Beneficiary designations – Who inherits your retirement accounts, life insurance, etc.

Why 2026 Actually Matters

We won’t go full tax-nerd here, but big picture:

Some of the current tax rules are set to change after 2025.

That may affect how much of your estate could be subject to taxes if your net worth is higher.

Even for families who aren’t ultra-wealthy, this is a perfect excuse to review and update your plan.

Bottom line: Don’t wait for Congress or the IRS to decide your family’s future. A little planning now can save your loved ones a lot of stress later.

“I’m Not Rich. Do I Really Need This?”

Short answer: Yes. Long answer: Still yes.

You may need an estate plan if:

You own a home or other property

You have kids, grandkids, or anyone you care about

You have retirement accounts, life insurance, or investments

You run a business or side hustle

You’ve said, “I don’t want my family to fight over this someday.”

Estate planning isn’t about how much you have — it’s about who you love and what you want to happen.

The 2026 Estate Planning Checklist

Here’s a simple, non-scary checklist to walk through in 2025–2026:

1. Get Clear on “Who’s Who”

Ask yourself:

Who should receive my assets?

Who should not receive anything?

Who do I trust to be in charge (executor or trustee)?

Who should care for my minor children (if applicable)?

Make a quick list — names only. You don’t have to solve everything in one day.

2. Take Inventory (No, You Don’t Need a Spreadsheet… But It Helps)

Write down the basics:

Home(s) and real estate

Bank accounts

Investment and retirement accounts

Life insurance policies

Business interests

Vehicles, collectibles, family heirlooms

This isn’t about judging where you are — it’s about knowing what you’re planning for.

3. Tune Up Your Beneficiaries

One of the easiest, most powerful steps:

Check who’s listed as your beneficiary on:

401(k), IRA, or other retirement accounts

Life insurance policies

Some bank or investment accounts with “payable on death” options

These often override what your Will says, so it’s crucial they’re up to date.

Divorced? Remarried? New grandchild? 2026 is a great “excuse year” to clean all this up.

4. Decide: Will, Trust, or Both?

This is where a professional really helps, but here’s the quick version:

Will-only plan

Usually simpler and less expensive up front

Still goes through probate (court process) after you pass

Good for very simple situations

Will + Living Trust

Can help your estate avoid probate

Offers more privacy and control

Can help with blended families, special needs, business owners, or multi-state property

You don’t have to make this decision alone. A good estate planning attorney or financial professional can help you figure out what fits your situation, your family, and your budget.

5. Add Powers of Attorney & Healthcare Documents

Estate planning isn’t just about what happens after you’re gone — it’s also about protecting yourself while you’re alive.

Consider:

Durable Power of Attorney – Someone you trust to handle financial/legal issues if you can’t.

Healthcare Power of Attorney – Someone who can talk to doctors and make medical decisions on your behalf.

Living Will / Advance Directive – Your wishes about life support, resuscitation, and other key medical decisions.

These documents can prevent family conflict, confusion, and guesswork in emotionally intense moments.

Common Myths About Estate Planning (Busted)

❌ Myth 1: “I’m too young.”

If you’re old enough to own a home, have kids, or drive a car you paid for… you’re not too young.

❌ Myth 2: “I don’t have enough money.”

Even modest estates can get stuck in court or cause arguments if there’s no plan.

❌ Myth 3: “I made a Will years ago. I’m done.”

Life changes. Laws change. Families change. Your plan should change too.

❌ Myth 4: “My family knows what I want.”

They might think they do… until they disagree. A written plan removes doubt (and drama).

Make Estate Planning Less Awkward: How to Talk About It

Estate planning can feel heavy, but the conversation doesn’t have to be.

Try:

“Hey, I’m updating my plan so it’s easier on you someday — can I share what I’m putting in place?”

“If anything ever happened to me, I want you to know where things are and who to call.”

“We should all have a plan. Have you thought about updating yours too?”

Sometimes the best gift you can give your family is clarity.

What You Can Do Before 2026

Here’s a simple action plan you can use right now:

Make your “who” list – who you trust, who you want to provide for.

List your major assets – house, accounts, policies, business interests.

Check your beneficiaries – make sure they match your current wishes.

Schedule a meeting with a qualified estate planning attorney or financial professional.

Tell someone you trust where your important documents will be kept.

Small steps now can make a huge difference later.

Final Thought: Estate Planning Is a Love Letter

At the end of the day, estate planning isn’t about forms, signatures, or fine print.

It’s about:

Protecting the people you love

Keeping more of what you’ve built in the hands of family, not chaos

Making sure your story continues the way you want it to

So as 2026 approaches, don’t think of estate planning as a chore.

Think of it as one of the kindest, most thoughtful gifts you’ll ever give.

IRA Rollovers and Qualified Charitable Distributions: Today’s Slott Report Mailbag

By Sarah Brenner, JD

Director of Retirement Education

Question:

My wife and I have a large disparity in IRA balances. It is about a 10 to 1 ratio. I would like to transfer a significant amount to her IRA.

Our brokerages say they do not allow these types of transfers. How do you manage to do that type of rollover?

Scott and Linda

Answer:

Hi Scott and Linda,

Unfortunately, you may not transfer your IRA funds to your spouse during your lifetime. That is not allowed under the IRA rules. The “I” in IRA stands for “individual.” The funds in it are solely for your benefit and, with very limited exceptions, cannot be transferred to anyone else during your lifetime. One exception is divorce, so if you are happily married that will not apply to you. You can name your spouse as your beneficiary though, and at your death she will inherit your IRA funds and can roll them over to her own IRA.

Question:

Good Day,

I just read Andy Ives’s Slott Report article entitled “Five Things You Need to Know about Qualified Charitable Distributions” and have a question he did not address in his article.

I inherited three IRAs from my mother and father who were both over age 70½ when they died. I know I must start taking required minimum distributions (RMDs) this year and I want to give this money to charity. So, instead of withdrawing in cash, having to pay ordinary income tax, and then making the donations, I would like to take these RMDs as qualified charitable distributions (QCDs). I am only 60 years old, but because the original owners were over age 70½ I am hoping this is doable.

Thank you kindly for your help.

Answer:

Some IRA beneficiaries can do QCDs from inherited IRAs. However, to be eligible, the beneficiary must be age 70½ or older. The age of the IRA owner does not matter. Because you are only age 60, you cannot do a QCD from the IRAs you have inherited.

If you have technical questions you would like to have answered, be sure to submit them to mailbag@irahelp.com, to be answered on an upcoming Slott Report Mailbag, published every Thursday.

https://irahelp.com/ira-rollovers-and-qualified-charitable-distributions-todays-slott-report-mailbag/

The Right Moves – How to Move Retirement Funds

By Sarah Brenner, JD

Director of Retirement Education

The year 2025 has been a turbulent time for the economy. Whether due to job loss or seeking better investment opportunities in volatile markets, the result is that more and more retirement account funds are on the move.

When retirement funds are in motion, there are rules that must be followed. Retirement account owners must be very careful to be sure that their funds are moved correctly. Otherwise, there could be taxes, penalties and the loss of hard-earned retirement savings.

The best way to ensure safe passage of retirement funds is to move the retirement funds directly from one retirement account to another.

Employer Plan Moves

From work plans, like a 401(k), this means doing a direct rollover to another plan or to an IRA.Instead of opting to receive the funds, the participant instructs the plan to send the funds directly to the receiving retirement account.

A check made payable to the receiving plan administrator or IRA custodian satisfies this requirement, even if it is sent to the plan participant. Money can also be moved this way from an IRA to an employer plan via “reverse rollover” if the plan allows.

IRA Moves

For IRA funds, the best way to move money is by doing a direct transfer. The IRA custodian would send the funds directly to the other IRA without the account owner taking receipt of the funds. (As with a direct rollover from a plan, a check from an IRA payable to the receiving custodian and sent to the IRA owner would qualify as a direct transfer.)

Whenever Possible – Avoid 60-Day Rollovers!

With a 60-day rollover, money is distributed to the account owner and subsequently deposited to an IRA within 60 days. A 60-day rollover is one way that funds can be moved from one retirement account to another, but it should be avoided whenever possible. This is because 60-day rollovers come with a lot of potential problems and risks.

For both plans and IRAs, doing a direct rollover or transfer instead of a 60-day rollover avoids the risk of missing the 60-day rollover deadline. Missing this deadline by even one day could mean the entire distribution would be taxable and ineligible to ever be deposited back into a retirement account.

For plan distributions, a direct rollover also avoids the mandatory 20% withholding rule that applies when rollover-eligible plan funds are paid to the plan participant. This rule can create headaches for participants who are looking to roll over the full amount of the distribution within 60 days because a portion will be lost to required withholding.

For IRAs, a transfer between IRAs eliminates concerns about the complicated once-per-year IRA rollover rule. This rule is tricky, and the IRS has no discretion to waive it. A direct transfer also avoids the hassle of the IRA owner having to report the move on her tax return for the year.

If you have technical questions you would like to have answered, be sure to submit them to mailbag@irahelp.com, to be answered on an upcoming Slott Report Mailbag, published every Thursday.

https://irahelp.com/the-right-moves-how-to-move-retirement-funds/

The Tricky Still-Working Exception – After Death

By Andy Ives, CFP®, AIF®

IRA Analyst

For those who have 401(k)s or other retirement plans, the required beginning date (RBD) when required minimum distributions (RMDs) are officially “turned on” is April 1 of the year after the year a person turns age 73. This is the same RBD applicable to IRAs. However, if a person is still working for the company that sponsors the 401(k), and if that person does not own more than 5% of the company, then RMDs from the company retirement plan can be delayed until April 1 of the year after the year the person retires. This is commonly called the “still-working exception.”

Some additional details about the still-working exception include the following:

- It only applies to RMDs from employer plans like a 401(k) or 403(b). It does not apply to IRAs or IRA-based plans like SEPs and SIMPLEs.

- It does not apply to employer plans if the person is not currently working for that company (e.g., plans from previous employers).

- The still-working exception is optional on the part of the plan. It is not a required design feature, although most plans allow it.

- An employee must work through the entire year for the still-working exception to apply for that year.

That last bullet point about retirement/separation from service trips people up the most. For example, if a 75-year-old employee retires in late December, then an RMD will apply for that same year. (That RMD can be delayed until April 1 of the next year unless a rollover is done prior to the RBD.) Or, if this hypothetical 75-year-old was laid off, that would also result in an RMD for that year. To ensure that an RMD is avoided for a particular year using the still-working exception, the safest bet is to schedule your official retirement/separation-from-service date for January 1 (or later) of the following year. (And, to avoid IRS scrutiny, you should actually work up to and including that January retirement date.)

Speaking of timing and separation from service, there is a tricky scenario with the still-working exception that must be considered.

Example: Roger is age 75 and still gainfully employed at ABC, Inc. He participates in the company’s 401(k) and has been delaying RMDs from the plan for a few years. Roger anticipates working until he is 80. Sadly, Roger had a heart attack and died. Of course, this ends Roger’s career at ABC, Inc., and he is no longer an employee.

Since Roger has separated from service (albeit not in the fashion he intended), and since he is no longer still working, does this mean he has an RMD from the ABC, Inc. 401(k) in his year of death?

He does not! Remember, the RBD (when RMDs are officially “turned on”) is April 1 of the year after the year person turns age 73, or April 1 of the year after the year a person retires if using the still-working exception. You must live long enough to reach that date for RMDs to officially begin. Since Roger died before the RBD applicable to his 401(k) plan, there is no year-of-death RMD from the plan for his beneficiaries to worry about.

If you have technical questions you would like to have answered, be sure to submit them to mailbag@irahelp.com, to be answered on an upcoming Slott Report Mailbag, published every Thursday.

https://irahelp.com/the-tricky-still-working-exception-after-death/

Weekly Market Commentary

Markets were choppy and ended the week with mixed results. Investors poured into risk assets on the idea that the longest US government shutdown was over, but a more hawkish tone from several Fed officials recalibrated expectations for a December rate cut and dampened the appetite for risk assets. Atlanta Fed President Rafael Bostic announced his retirement in February and voiced concerns over inflation. St Louis Fed President Musalem echoed those concerns, while Boston Fed President Susan Collins said it would be appropriate to keep rates at their current levels for some time. Minneapolis Fed Governor Kashkari stated that he was not in favor of the most recent rate cut and still had questions about whether a December rate cut was necessary. Kansas City Fed President Schmid also pushed back on the notion of a December rate cut. All that said, a couple of weeks ago, the likelihood of a December rate cut stood above 94%; at the end of the week, that probability had fallen to less than 50%. A clear rotation was again visible this week, as the healthcare and Consumer staples sectors were bid, while money was taken off the table in some of the high-flying technology issues. Concerns over debt issued to finance AI initiatives at Oracle led to credit default swaps on that paper trading materially higher. Valuation concerns continued even as AMD expressed its AI addressable market could exceed $1 trillion dollars and Anthropic announced a $50 billion US infrastructure investment. SoftBank’s sale of its position in Nvidia also raised questions on the Tech trade, even though the company has earmarked $22.5 billion for OpenAI investments. Nvidia will set the tone for the markets when it announces earnings on Wednesday, the 19th.

The S&P 500 gained 0.1%, the Dow added 0.3%, the NASDAQ fell by 0.5%, and the small-cap focused Russell 2000 shed 1.8%. US Treasury yields increased across the curve. The 2-year yield increased by five basis points to 3.61%, while the 10-year yield increased by six basis points to end the week at 4.15%. Reports from OPEC+ that suggested that oil demand would be in line with its supply, along with increased tensions with Russia and news that Iran had seized a tanker in the Strait of Hormuz, created plenty to trade on within the oil market. Oil ended the week at $60.08, up $0.35. Gold prices increased by $85.20, or 2.12%, to close at $4,095.20 per ounce. Copper prices rose by $0.10 to $5.06 per Lb. Bitcoin prices plunged by 6.28% and closed the week at $95,643. The US Dollar index fell 0.3% to close at 99.30.

Data on the economic front was quiet. However, that is set to change as a deluge of data is expected to hit markets in the coming weeks, following the delay of more than a month’s worth of data due to the government shutdown. White House Press Secretary Karoline Leavitt suggested that some of the delayed data may never be announced. The bottom line is that several data sets are expected to be released and may have an impact on whether the Fed cuts rates in December, thereby increasing the likelihood of further market volatility. This week, we will also get a read on the consumer through the lens of Walmart and Target’s Q3 earnings announcements.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

Retirement Planning in 2026: How to Prepare for a New Era of Retirement

If you feel like retirement has gotten more complicated, you’re not imagining things. Between market volatility, rising costs, new tax rules, and longer life expectancies, “set it and forget it” retirement planning just doesn’t work anymore.

The good news? With a clear strategy and a few smart moves, 2026 can be the year you take control of your retirement plan instead of letting the markets, taxes, or inflation control you.

In this article, we’ll walk through the key steps to prepare for retirement in 2026 and beyond—whether you’re 5 years away, 15 years away, or already retired and want to make sure your money lasts.

1. Start With Your “Real Life” Retirement Vision

Before you look at accounts, charts, or statements, step back and ask:

When do I want to retire?

Where do I want to live? One home, two homes, or downsizing?

What does a normal Tuesday in retirement look like?

Who am I supporting—myself, a spouse, kids, grandkids, or aging parents?

From there, put some numbers around it:

Essential expenses – housing, utilities, food, healthcare, insurance, transportation.

Lifestyle expenses – travel, hobbies, dining out, gifts, and helping family.

“Dream” expenses – big trips, second home, starting a business, charitable giving.

This becomes your retirement income target—the foundation for every planning decision that follows. Without this, you’re just collecting account balances without knowing what they really need to do for you.

2. Stress-Test Your Income: Will Your Money Last 25–30+ Years?

Retirement is no longer a 10–15-year event. For many people, it’s a 25–30+ year season of life. That makes running out of money one of the biggest risks.

Key questions to review:

What are my guaranteed income sources?

Social Security

Any pensions

Annuity income (if you have it)

How big is my “income gap”?

Take your total monthly needs in retirement and subtract your guaranteed income. The difference is what your savings and investments must reliably cover.How exposed am I to market swings?

If another 2008-style drop or 2020-style shock hit early in your retirement, would your lifestyle be at risk? This is called sequence of returns risk—and it’s a real danger for retirees drawing income from volatile accounts.Do I have any “never touch” money?

Money earmarked for later-in-life care, a surviving spouse, or legacy should often be protected differently than money you plan to spend in your 60s and early 70s.

If you’ve never had your retirement plan stress-tested under different market and longevity scenarios, 2026 is the year to do it.

3. Get Strategic About Taxes—Especially Before the 2026 Tax Sunset

One of the biggest “stealth threats” to retirement is taxes. Current federal income tax rates, which were reduced under the 2017 Tax Cuts and Jobs Act, are scheduled to sunset after 2025, which means rates are currently set to increase in 2026 unless new legislation changes the rules.

That makes the next few years especially important for tax planning.

Here are key ideas to consider (with a qualified tax professional and financial advisor):

Roth Conversions While Rates Are Lower

If you have large balances in traditional IRAs or 401(k)s, withdrawals in retirement are fully taxable. Converting some of that money to Roth while rates are lower may help:

Move money from “tax later” to “tax never again” (if rules are followed).

Reduce future Required Minimum Distributions (RMDs).

Potentially lower future taxes for a surviving spouse or heirs.

You do pay tax on the amount converted, so this has to be planned carefully over multiple years—often “filling up” your current tax bracket without jumping to the next one.

Diversifying Your “Tax Buckets”

Rather than having all your money in tax-deferred accounts, consider building three buckets:

Taxable – brokerage accounts, savings, CDs.

Tax-Deferred – traditional IRA, 401(k), 403(b), etc.

Tax-Free (if rules are followed) – Roth IRA, Roth 401(k), cash value life insurance structured properly, HSAs used correctly.

In retirement, having options from each bucket can help you control your taxable income each year and keep more of your Social Security and Medicare premiums.

4. Inflation and Healthcare: Two Costs You Can’t Ignore

Most people underestimate two things: how long they’ll live and how much things will cost.

Plan for Rising Costs

Even “modest” inflation of 3–4% can dramatically increase your cost of living over a 20- to 30-year retirement. Building in cost-of-living increases to your income plan is essential.

Consider:

Investments and strategies that have the potential to outpace inflation over time.

Guaranteed income sources that offer inflation protection (where available).

Keeping some growth-oriented assets, even in retirement, for the long term.

Healthcare and Long-Term Care

Healthcare is often one of the largest expenses in retirement. You’ll want to consider:

Your Medicare options and the true out-of-pocket costs of each path.

A plan for long-term care—whether through insurance, hybrid life/long-term care products, or earmarked assets.

How a serious health event would impact a surviving spouse’s lifestyle and income.

Building these into your retirement plan now can help prevent a crisis later.

5. Revisit Your Investment Strategy for the 2026 Landscape

Markets change. Interest rates change. Risk tolerances change. Yet many people are still using the same mix of stocks and bonds they picked a decade ago.

Going into 2026, it’s wise to review:

Risk vs. Time Horizon

Money you’ll need in the next 3–5 years should generally be more conservative and less exposed to market swings.

Money you won’t touch for 10+ years may still need growth potential to keep up with inflation.

Smarter Diversification

Diversification isn’t just “own some stocks and some bonds.” It can include:

Different sectors and regions

Different asset classes (equities, fixed income, alternatives as appropriate)

Different strategies (growth, value, income, protection-focused tools like fixed annuities or fixed indexed annuities)

The goal is not to “beat the market,” but to fund your retirement goals with the least amount of unnecessary risk.

Income-Focused Design

As you get closer to retirement, the question becomes less “What’s my account worth?” and more “How much reliable income can this portfolio generate?”

That often means:

Shifting portions of your portfolio from pure growth to income and protection.

Considering tools designed for lifetime income, like certain types of annuities, when appropriate and understood.

Matching specific accounts or tools to specific goals: income, safety, legacy, or growth.

6. Don’t Forget Protection: Insurance, Estate Planning, and Beneficiaries

A strong retirement plan isn’t just about how much you have—it’s about how well it’s protected.

Insurance Checkup

Do you have the right amount (and kind) of life insurance for your current stage of life?

Have you reviewed any policies with cash value to see how they fit into your retirement and legacy plan?

Have you considered how medical events, disability, or long-term care could impact your spouse or family?

Estate and Legacy Planning

You don’t need to be “wealthy” to need an estate plan. At a minimum, you should have:

A will

Updated beneficiary designations on retirement accounts and life insurance

Powers of attorney and healthcare directives

A clear strategy for who inherits what, and how

For more complex situations, trusts and other advanced tools may make sense—especially if you have blended families, a special-needs child, business interests, or property in multiple states.

7. Make 2026 the Year You “Get Organized”

One of the most underrated parts of retirement planning is simple: organization.

Here’s a practical checklist to tackle in 2026:

Gather all your account statements and policies in one secure place.

Make a master list: account numbers, institutions, contact info, and login details (stored securely).

Write down who your key professionals are: financial advisor, CPA, attorney, insurance agent.

Create a “legacy folder” so a spouse or loved one could step in if something happened to you.

This not only makes planning easier—it also makes things dramatically easier for the people you love.

8. Work With a Guide, Not Just a Website

There’s more information than ever online, but information is not the same as a personalized plan.

A retirement-focused financial professional can help you:

Coordinate your income, investments, taxes, and insurance into one cohesive strategy.

Stress-test your plan for different market, tax, and longevity scenarios.

Build a written retirement income plan that you can understand and actually follow.

Adjust as life changes—health events, job changes, inheritances, caregiving, or a new vision for retirement.

Final Thought: The Best Time to Start Is Now

You can’t control the markets. You can’t control what Congress will do in 2026. But you can control how prepared you are.

Whether you’re just starting to think about retirement or you’re already retired and want more confidence, make this your action plan for 2026: