Privacy Policy

How we collect, use, and safeguard your information at Texas Retirement Solutions. Your trust matters—here’s exactly how we protect it.

Privacy Policy

Who We Are & How to Reach Us

Texas Retirement Solutions

Attn: Privacy

5801 W. Interstate 40, Suite 101, Amarillo, TX 79106

Quick Navigation

1) Scope

This Policy explains how we collect, use, disclose, and protect personal information when you visit our website, contact us, attend our events, or use our retirement and insurance services. If you become a client, we may provide a separate financial privacy notice (e.g., under the Gramm-Leach-Bliley Act). Where that notice conflicts with this Policy, it controls for client financial information.

2) Information We Collect

Information you provide directly

- Contact details (name, email, phone, mailing address).

- Information you share during consultations (goals, risk tolerance, financial profile).

- Communications (emails, call notes, web forms, event registrations, surveys).

Information collected automatically (online)

- Device/usage data (IP address, browser type, pages viewed, timestamps, referrers).

- Cookies, pixels, and similar technologies for site functionality, analytics, and (if enabled) advertising.

- Approximate location (derived from IP).

Information from third parties

- Referral partners, analytics/advertising platforms, public sources, and service providers.

- With authorization, account/policy data from custodians, insurers, or recordkeepers.

We do not knowingly collect information from children under 13.

3) How We Use Information

- Provide, operate, and improve our services and website.

- Respond to inquiries, schedule appointments, and deliver educational content.

- Personalize experiences and recommend relevant content/services.

- Analytics, security, debugging, and fraud prevention.

- Marketing and events (you may opt out at any time).

- Comply with legal/regulatory obligations and enforce our terms.

4) Legal Bases (EEA/UK)

Where applicable, we process personal data based on: (i) performance of a contract or pre-contract steps; (ii) legitimate interests (e.g., service improvement, security, client communications); (iii) consent (e.g., certain marketing cookies); or (iv) legal obligations.

5) Sharing & Disclosure

We do not sell personal information. We may share with:

- Service providers (processors) such as hosting, email/CRM, analytics, IT/security, advertising, and professional advisors, bound by contract to protect your data and use it only as instructed.

- Business partners as needed to deliver services you request (e.g., insurers, custodians).

- Legal/Compliance (regulators, auditors) or to protect rights, safety, or comply with law.

- Corporate events (merger, acquisition, asset transfer) subject to this Policy or successor protections.

6) Cookies & Analytics

We use cookies and similar technologies to enable site features, understand performance, and (if enabled) measure advertising effectiveness. You can control cookies in your browser. Some features may not function without certain cookies.

7) Data Retention

We retain personal information only as long as necessary for the purposes described, to meet legal and regulatory requirements (which can be lengthy for financial records), resolve disputes, and enforce agreements.

8) Security

We employ administrative, technical, and physical safeguards designed to protect personal information (e.g., access controls, encryption in transit where appropriate). No method of transmission or storage is 100% secure.

9) Your Choices

- Marketing opt-out: Unsubscribe via the link in our emails or contact us.

- Cookie controls: Adjust browser settings or use our cookie tools if provided.

- Update your info: Contact us to review or correct your information.

10) U.S. State Privacy Rights

Depending on your state, you may have rights to request access, correction, deletion, or to opt out of certain uses (e.g., targeted advertising). To submit a request, email hollie@texasretirementsolutions.com or call (806) 242-0550. We will verify your identity before acting. Authorized agents may submit requests with proof of authorization.

Texas residents: We strive to honor applicable Texas privacy rights, including rights to access, delete, and correct certain personal data, and to opt out of targeted advertising or sales (we do not sell personal information). Sensitive personal data (if any) is collected only as necessary with appropriate notices/consents.

If you believe your request was denied in error, you may appeal by replying to our response or emailing with the subject line “Privacy Appeal.”

11) Financial Privacy (GLBA) for Clients

For clients, we provide a separate GLBA Privacy Notice describing how we handle non-public personal information (NPI). That notice governs NPI we collect in providing financial services. Contact us if you need another copy.

12) Third-Party Links & Tools

Our website may link to third-party sites or embed tools (e.g., maps, video, scheduling, analytics). Those parties maintain their own privacy practices; we encourage you to review their policies.

13) International Visitors

If you access our site from outside the United States, your information may be processed in the U.S., where privacy laws may differ from those in your country.

14) Changes to This Policy

We may update this Policy periodically. The “Last updated” date above reflects the latest revision. Material changes will be highlighted on this page and/or communicated as appropriate.

15) Contact

Questions or requests regarding this Policy?

Texas Retirement Solutions — Privacy

5801 W. Interstate 40, Suite 101, Amarillo, TX 79106

(806) 242-0550 • hollie@texasretirementsolutions.com

Long-Term Care

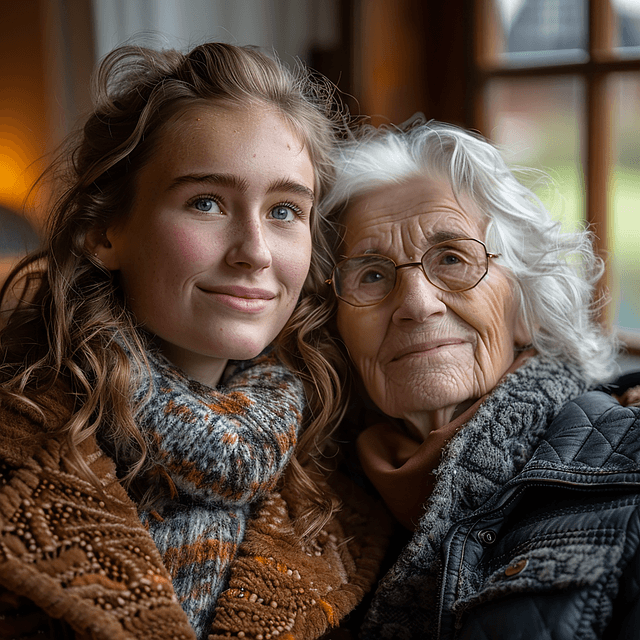

Sad but true: Life is not forever

We try to ignore it, but the sad fact is, we age. Our bodies betray us. We become frail.

Yet a startlingly large number of people do not have Long Term Care insurance. That’s called “Denial.”

The shock often comes in your 60’s or 70’s, when you realize the time for Long Term Care is rapidly approaching, and you discover how expensive it’s become.

Let’s talk through options now—coverage types, benefit periods, elimination periods, inflation riders, and how LTC integrates with your retirement income plan.

Facing the Reality of Aging

It’s natural to put off thinking about aging and the challenges it can bring. But our health changes over time, and many of us will eventually need assistance with daily living. Planning early helps ensure that when the time comes, you’re prepared—financially, emotionally, and with greater peace of mind.

Why Plan Sooner?

- Lower cost & easier approval: Health underwriting is generally more favorable at younger ages.

- More choices: Traditional LTC, hybrid life/LTC, and annuities with LTC riders.

- Asset & income protection: Help preserve savings and provide flexibility for loved ones.

- Care on your terms: Plan for care at home, assisted living, or nursing care.

Common Misconceptions

- “I won’t need it.” A significant share of retirees need some level of support with daily activities.

- “Medicare will pay.” Medicare is limited for long-term custodial care; LTC planning fills the gap.

- “I’ll self-insure.” Feasible for some, but may strain portfolios and limit choices during market downturns.

Where Care Happens

- In-home care & care coordination

- Assisted living & memory care

- Skilled nursing facilities (as needed)

Ways to Prepare

- Traditional Long-Term Care insurance

- Hybrid life insurance with LTC benefits

- Annuities with LTC riders

- Budgeting & earmarked savings

Your First Steps

Note: Product features, underwriting, and availability vary by state and insurer. This block is general education, not financial or tax advice.

Get Coverage While You’re Young

The earlier you purchase Long-Term Care insurance, the more affordable it is. Premiums are significantly lower at younger ages, and the cost can be spread out over more years, making it easier to manage. Very few people who purchase LTC coverage ever let it lapse — because they understand its long-term value.

Why Long-Term Care Insurance Matters

The costs of long-term care can rapidly deplete a family’s savings. Too often, people must sell assets or rely on children — creating financial strain and emotional stress. LTC insurance helps protect your finances, relationships, and peace of mind.

Earlier vs. Later: A Simple Example

- Wait until age 75: Premiums and out-of-pocket costs are often substantially higher due to age and health risks.

- Buy at 55, 50, or younger: Premiums are lower, coverage is easier to secure, and later-life costs are minimized.

Planning early not only protects your future care options but also helps you lock in the best possible value.

In-Home Care (Typical Costs)

- National average ~$33/hour

- California typical range: $32–$40/hour

- 24-hour care: $20,000–$27,000/month (≈ $240,000+/year)

- $1M in benefits may cover roughly 3–4 years of full-time in-home care

Assisted Living (Typical Costs)

- National median: ~$5,350/month (≈ $178/day)

- California average: $5,250–$6,250/month (≈ $63k–$75k/year)

- $500k in benefits could provide roughly 7–8 years of coverage (varies by location & care level)

Why It Matters

Long-term care is not one-size-fits-all. Needs can change suddenly — from part-time help at home to full-time care or assisted living. Having the right coverage in place ensures flexibility and peace of mind for you and your family.

Note: Costs and availability vary by state, carrier, and care setting, and they change over time. This block is general education, not financial, tax, or legal advice.