Market Review and Outlook

These are not the opinions or recommendations of Texas Retirement Solutions or Sound Income Strategies LLC, but rather of third party contributors.

Weekly Market Commentary

-Darren Leavitt, CFA

It was an extremely busy week on Wall Street. First-quarter earnings results were highlighted by Apple and Amazon. Investors encouraged by their results sent higher shares on the back of increased dividends, increased share buyback programs, and increased AI capital expenditures. The May FOMC meeting yielded no change to the Fed’s policy rate, which stays at 5.25%- 5.50%. However, Chairman Jerome Powell came off much more dovish than expected. The Chairman said that it was unlikely that the Fed would raise rates despite the lack of further progress over the last couple of months toward reaching the Fed’s inflation target. This statement, coupled with a weaker-than-expected Employment Situation Report, sent US Treasury yields lower on the week and recalibrated the timeline for when the Fed is expected to start cutting its policy rate from December to September.

The S&P 500 gained 0.5%, the Dow rose 1.1%, the NASDAQ climbed 1.4%, and the Russell 2000 advanced by 1.7%. The S&P 500 sits right below its 50-day moving average, while the NASDAQ was able to trade and settle above its 50-day moving average. US Treasuries gained across the curve, with shorter tenors slightly outperforming. The 2-year yield fell nineteen basis points to 4.81%, while the 10-year yield decreased by seventeen basis points to 4.50%. Talks of a ceasefire in Gaza took some of the risk premium out of the crude market. WTI prices fell by nearly 7% on the week and closed at $78.05 a barrel. Gold prices fell by $39.70 or 1.6% to $2308.20 an Oz. Copper prices fell by two cents to $4.55 per Lb. The US Dollar index fell on the reset of rate cut expectations and a strong currency intervention by the Bank of Japan to strengthen the Yen. Last Sunday, the Yen touched 160 and closed Friday at 152.95. The DXY closed the week down 1% at 105.04.

The economic calendar was full this week. The Employment Situation Report surprised to the downside. Non-farm Payrolls increased by 175k versus the consensus estimate of 250k. Private Payrolls were up by 167k versus the estimate of 175k. The Unemployment rate ticked up by .1% to 3.9% higher than the expected 3.8%. Average Hourly Earnings increased by 0.2%, but was lower than the expected increase of 0.3%. The Average Workweek was also lower than expected at 34.3. The report supports the idea that the economy is still doing well and also supports the idea that the next move by the Fed will be a cut. That said, the week started with a stronger-than-anticipated Employment Cost Index, which increased by 1.2% and catalyzed a broad sell-off in the markets. April Consumer Confidence fell to 97 from the prior reading of 104. Initial Claims and Continuing Claims were flat over the prior week, coming in at 208k and 1.744m, respectively. ISM Manufacturing came in at 49.2, indicating that the manufacturing sector is in contraction, while the ISM Services reading came in at a surprising 49.4, also indicating that the services sector has entered into contraction.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

June 2022 Market Review and Outlook

Monthly Commentary – June ’22

-Darren Leavitt, CFA

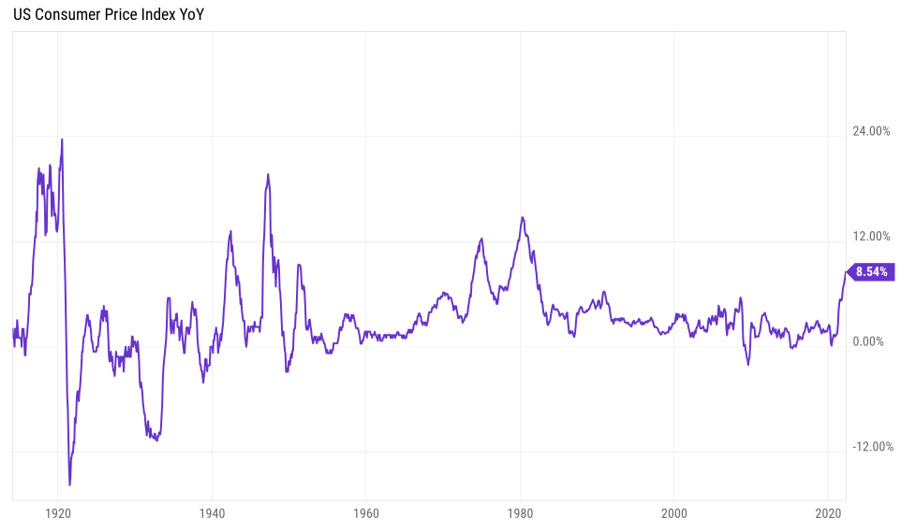

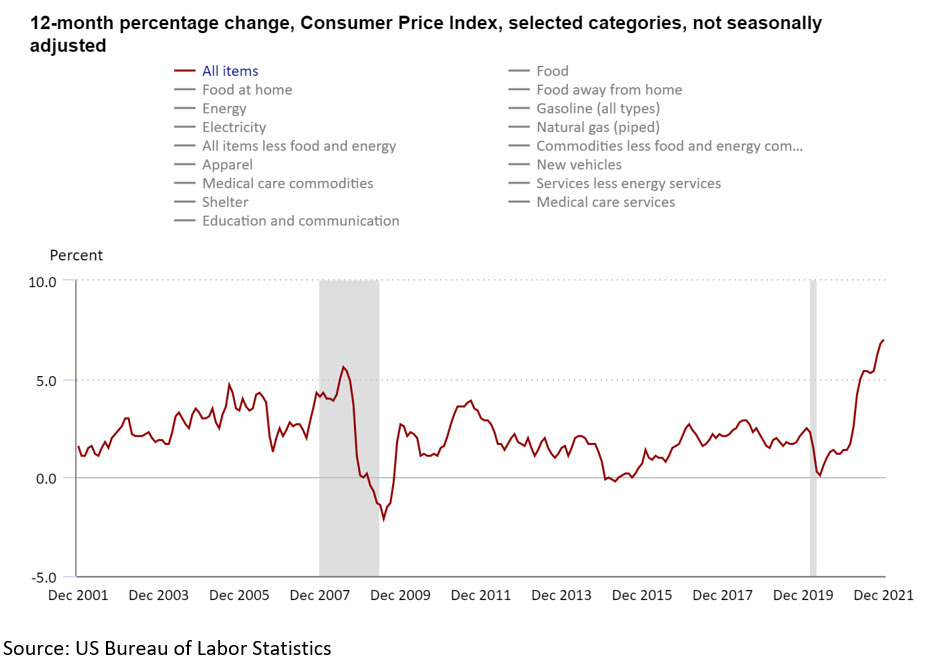

It was just an ugly month of June for investors and for that matter the 1st half of 2022. All asset classes seemed to fall except for the US dollar. The month started with a “peak inflation” narrative that was quickly put to rest after a dismal CPI report that showed no moderation in prices. Consumer Confidence and Sentiment indicators have plummeted and are clearly problematic for investors. Retail Sales figures announced in June were also disappointing. The housing market has simmered down after mortgage rates hit 13-year highs. That said, the labor market continues to be strong, and generally speaking, consumer and corporate balance sheets are in good shape.

Inflation continued to be top of mind for investors and global Central Bankers, who vowed to get prices under control. The Federal Reserve raised its policy rate by 75 basis points and telegraphed the need for more hikes in the next two meetings. The UK, Australia, Canada, and Brazil followed suit by raising their respective policy rates. The ECB announced that it would end its QE program earlier than had been expected and announced that it would raise its policy rate in its July meeting. On the other hand, Japan and China continued to stimulate their economies.

The tightening of financial conditions stoked fears of recession. In reality, the US economy may already be in a recession. The 3rd estimate of Q1 US GDP was revised lower to -1.6%, and the Atlanta Fed has projected 2nd quarter GDP to fall by 2.1%. Technically, a recession is defined as two consecutive quarters of negative GDP growth. The million-dollar question at hand is how much of this is priced into the market. History shows the nadir of the S&P 500 while in recession at -24%. We have touched that level, but the jury is still out. The balancing act by the Fed and other Central banks is going to be difficult and has been conceded to most likely end in a bumpy or hard landing.

Over the month, it was apparent investors have started to move into the countercyclical sectors and away from their counterparts. Consumer staples, Utilities, and Healthcare were relative beneficiaries of the move. The S&P 500 lost 8.39%, the Dow declined by 6.71%, the NASDAQ gave up 8.71%, and the Russell 2000 shed8.37%. Developed International markets lost 9.79% while Emerging Markets fell by 5.29%. The US Treasury market continued to be volatile and offered investors no haven. The 2-year yield increased by thirty-nine basis points to close at 2.93%. The 10-year yield closed thirteen basis points higher at 2.97%. Notably, the 10-year traded as high as 3.5% in June before rallying in the last couple of weeks. WTI prices fell 8% or $9.16 to close at $105.77 a barrel. Gold prices declined by 2% or $39 to $1808.60 an Oz. Copper prices fell 13% or $0.58 to $3.71 an Lb.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

April 2022 Market Review and Outlook

Monthly Market Commentary – April ’22

-Darren Leavitt, CFA

Global financial markets had a rough month in April. Inflation continued to be top of mind for investors as data continued to show historic increases in prices. The Federal Reserve still appears to be behind the curve in combating inflation, but throughout the month, Fed officials provided multiple indications that more action would be taken. The more hawkish rhetoric took a toll on the yield curve, which saw massive swings over the month. The headwind of higher interest rates also continued to hit global equities. The S&P 500 could not hold critical areas of technical support, which left the index vulnerable to a late-month sell-off. Q1 earnings started with mixed results and were on the margin disappointing for the mega-cap leadership names, i.e., Apple, Google, Facebook, Amazon, and Microsoft.

China’s zero Covid policy continued to wreak havoc on the global supply chain as major factories shut down. China did respond with more monetary stimulus and a pullback on its most recent regulatory crackdown. The Russian and Ukraine war continued without a resolution, contributing to global inflation woes. Russian atrocities against Ukraine induced more sanctions and invoked international calls for more military and humanitarian aid.

Economic data showed inflation running hot in multiple data series. Data also showed a slowdown in manufacturing and services while the labor market continued to be tight. Interestingly, sentiment indicators and retail sales have held up nicely.

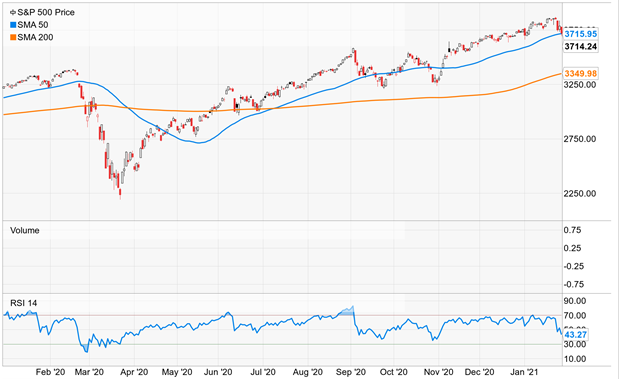

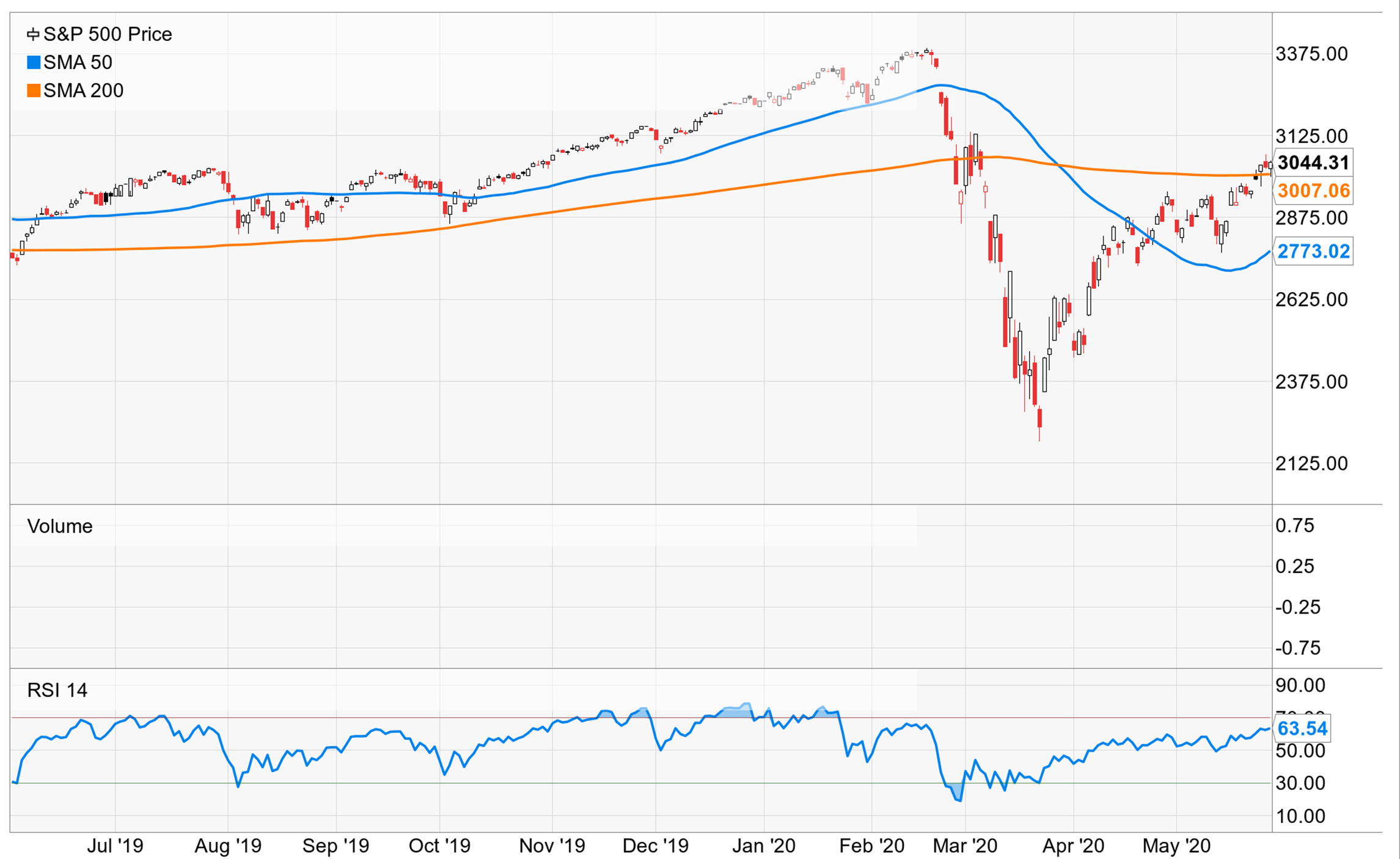

The S&P 500 lost 9.11%, the Dow gave back 5.29%, the NASDAQ decreased by 13.51%, and the Russell 2000 shed 10.86%. International developed markets lost 7.61%, while emerging markets pulled back 7.67%. Technically, the S&P 500 became vulnerable to more losses as the index broke down below its 200-day moving average of 4495 and then through the support of its 50-day moving average of 4418. Currently, the market looks oversold, and many contra indicators suggest we could see a bounce.

The yield curve was all over the place in April. We started the month with an inverted curve where the 2-10 spread went negative. The inversion was short-lived, and then we saw the 2-10 spread expand back to 38 basis points only to have it compress again. For the month, the 2-year yield increased forty-one basis points to 2.69%, while the 10-year yield increased by fifty-six basis points to close at 2.89%. It is widely accepted that the Fed will raise its policy rate by 50 basis points in the May meeting and start to normalize its balance sheet by $95 billion a month.

Oil was one of the only assets to gain in the month. Oil prices increased 4.5% or $4.60 to close at $105.03 a barrel. Gold prices fell 2.1% or $41.70 to $1911.30 an Oz. Copper prices fell 7% or $0.34 to $4.41 an lb. The dollar continued its strength against other majors. The $/Yen climbed north of 130, the lowest level since 2002. The Euro/$ fell to 1.0565, the lowest level since 2016.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

January 2022 Market Review and Outlook

Monthly Market Recap for January 2022

-Darren Leavitt, CFA

It was not a pleasant start to 2022 for investors as global financial markets took a few steps back. Increasing inflation concerns and the prospect for higher interest rates dampened sentiment. The Omicron variant also did not help matters as infections increased and hindered the economic recovery. Geopolitical tensions were also on investors’ minds as Russia continued to position troops on the border of Ukraine.

Consumer prices in December increased 7% on a year-over-year basis, the hottest reading since 1982. Similarly, Producer Prices increased by 9.7%. The preferred measure of inflation by the Federal Reserve, the PCE, was up 5.8% over the last year. Wages and increased housing costs appear to be the most permanent components of inflation. Still, commodity input prices and freight costs continued to manifest strains within the global supply chain. To combat inflation, the Federal Reserve is now likely to raise rates in March after it has wound down its asset purchasing program. Additionally, the market has priced in four rate hikes in 2022, much more than anticipated just a couple of months ago.

The notion of higher rates resets investment fundamentals. The hardest hit in the reset has been growth stocks which were down 9.3% relative to value stocks that lost just 1.2%. Higher valuations in growth stocks come under pressure as interest rates rise. The bond market also comes under pressure as rates rise. The yield on the 2-year note increased forty-three basis points in January, closing at 1.16%. The 10-year bond yield increased by twenty-seven basis points to 1.78% while the 30-year bond increased nineteen basis points to 2.10%. Interestingly, longer-dated Treasuries did not sell off as much.

The Omicron variant, while more infectious, has proven to be less severe, especially in those that have been vaccinated. However, the virus still induced lockdowns across multiple geographies and stalled the economic recovery. The surge of infections from December and January hurt consumer sentiment, which fell to 67.2 in January from the prior reading of 68.8. The variant also dampened retail sales, which fell 1.9% in December. While these variables likely played a role in the January sell-off, it appears Omicron infections are receding. That coupled with a well-positioned consumer may lead to a hasty jumpstart to the economic recovery in the coming months.

US, NATO, Russian, and Ukraine tensions monopolized headlines throughout January and influenced markets. An escalation and an eventual invasion of Ukraine would have widespread consequences. Oil and Natural Gas prices soared in January partly on the likelihood of supply disruptions if there is a conflict. Stiff economic sanctions on Russia have been on the table in negotiations and, if acted on, will cause more interruptions to the supply chain outside of the energy complex.

The S&P 500 lost 5.3%, the Dow shed 3.3%, the NASDAQ fell 9.5%, and the Russell 2000 gave back 9.7%. International Developed markets were down 5 .3%, and emerging markets lost 1.9%. The Treasury curve flattened with the 2-10 spread decreasing to sixty-two basis points. The global bond aggregate index fared better than equities losing 2%. A combined measure of US Treasures fell 1.9%, while emerging market debt fell 2.9%. Gold prices fell 1.7% or $31.6 to $1796.5 an Oz. Oil prices increased by a whopping 17.3% or $13.01 to close at $88.16 a barrel.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

December 2021 Market Review and Outlook

-Darren Leavitt, CFA

US financial markets rallied in December in volatile trade. It seemed markets would take two steps forward in one week only to give up a step in the following week.

The emergence of the Omicron variant rattled markets initially, but investors were encouraged from reports that the variant, while more infectious, produced less severe illness. News that our current vaccination regimes are effective also helped sentiment. The Biden administration announced no new lockdown measures in the US and induced FEMA into action where needed. The President also announced that there would be 10,000 new vaccination sites opened across the country and that the government had procured half a billion rapid Covid tests that it would make available to citizens. All that said, the highly contagious variant did cause disruptions in travel and lead some employers to extend the timeline for work at home initiatives and has likely disrupted parts of the supply chain.

Global central bank policy announced in December showed policy divergence across the globe. The December FOMC meeting will likely be seen as an inflection point in US monetary policy and exemplified by the Fed Chairs’ contention that we should stop using the word transitory when describing the current inflation environment. The more hawkish tone has come off the back of historic inflation that has been more persistent than most had predicted. The Fed announced that it would increase the pace of its taper to $30 billion a month and would wrap up its asset purchase program by the end of March 2022. The Fed did not change its policy rate but did telegraph its projections for three rate hikes in 2022. The US Treasury market sold off on the news, with the front end of the curve taking the brunt of the sell-off. The Bank of England surprised the markets with an increase in its policy rate. The ECB and BOJ announced that they would also taper their asset purchasing plans, but their tapers would like to run into 2023. Interestingly, the PBOC is moving in the opposite direction, easing policy to stimulate economic growth.

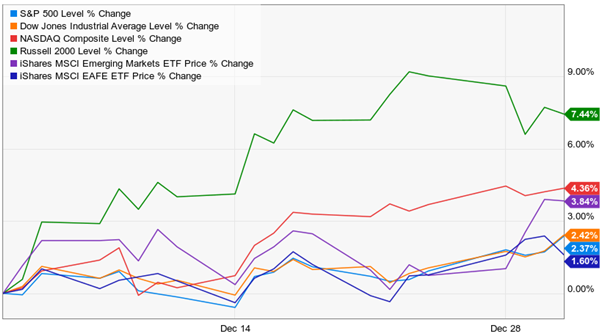

The S&P 500 gained 5.61% in December. The Dow added 6.81%, the NASDAQ increased 2.56%, and the Russell 2000 rose 4.56%. Developed international markets increased 2.98%, and Emerging Markets continued to struggle, losing 0.35%. The US Treasury curve flattened as the 2-year yield increased twenty-one basis points to close at 0.73%. The 10-year yield rose by seven basis and closed at 1.51%. Some have suggested that the curve’s flattening is projecting a policy error by the Federal Reserve that could end in a recession. Oil prices increased 13.6% over the month or $9.01 to close at $75.15 a barrel. Gold prices increased by $51.2 or 3% to $1828.10 an Oz.

Economic data in December was mixed. On the labor front, high-frequency data on Initial Claims and Continuing Claims continued to improve. However, the November Employment Situation report was underwhelming. The report showed an increase of 210k non-farm payrolls, much less than the anticipated 545k. Private payrolls also missed the mark at 235k versus the consensus estimate of 500k. The Unemployment rate fell to 4.2% from 4.6%, and Average Hourly earnings increased by 0.3%, lower than the prior increase of 0.4%. Inflation readings continued to be red hot. The CPI increased by .8% on a month-over-month basis and was up 6.8% over the prior year, the largest annual increase since 1982. Headline PPI increased by 9.6% year-over-year. ISM Manufacturing and Services data continued to show economic expansion. Retail Sales were a bit of a disappointment but likely came in short due to holiday demand being pulled forward on supply chain concerns. The housing market continued to show strength, and Consumer Sentiment rose in December.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

Monthly Market Review for September 2021

-Darren Leavitt, CFA

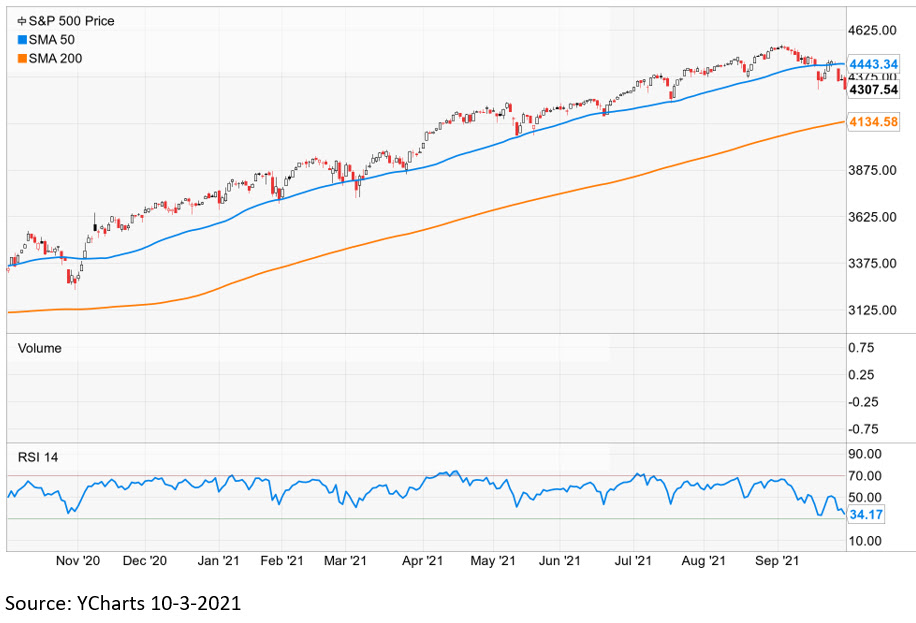

September proved again to be a difficult month for financial assets. A narrative that the growth of global economies has peaked was evident during the month. Market sentiment was further dampened by fears that inflation has become persistent rather than transitory. While still very accommodative, global central bank policy became a bit more restrictive with the rhetoric around tapering asset purchase programs and expectations of future rate hikes. Washington continued to be in a stalemate concerning infrastructure spending and policy related to increasing the debt ceiling. China continued its regulatory crackdown while one of the country’s largest land developers failed to make debt payments. Technically, the S&P 500 broke down below its 50-day moving average, which may portend a more significant pullback. Economic data was mixed over the month. Employment data continued to trend in the right direction while sentiment indicators waned. Housing continued to be a source of economic strength with better than expected data across the board, and ISM manufacturing and Services pointed to continued expansion.

The S&P 500 lost 4.79% for the month, the Dow gave back 4.16%, the NASDAQ declined 5.62%, and the Russell 2000 shed 3.62%. International developed markets fell 4.13%, while emerging markets tumbled 5.09%. Only one of the S&P 500’s 11 sectors was positive on the month; the energy sector gained 9.15%. Fears of inflation and a reshaping of Federal Reserve policy steepened the US yield curve. The 2-year note yield increased nine basis points to 0.29%, while the 10-year bond yield jumped twenty-three basis points to 1.53%. Bond prices fall as yields increase. Gold prices fell 3.3% or $76.18 to close at $1756.60 an Oz. Oil prices surged 10.67%, with WTI prices increasing by $6.63 to close at $75.07 a barrel. Copper prices fell to losing 6.5% to close just above $4 an Lb. Cryptocurrencies were also quite volatile and posted losses for the month. Bitcoin closed 6.5% lower in September.

Inflation expectations increased during the month and were clearly reflected in the move of US Treasuries. Prices at the producer and consumer levels increased on an overall basis and a core basis. Headline PPI rose 0.7%, while core PPI increased 0.6%. The year-over-year increase for PPI final demand was up 8.3%. Headline CPI increased 0.3%, and core CPI rose 0.1%. The year-over-year rise in CPI was 5.3%. The Fed has said that it is willing to let inflation run hot for a while to allow the labor market to recover. That said, the Fed indicated that it would most likely start tapering its asset purchase program in November, with the tapering concluding in Mid-2022. Similarly, the ECB announced that it would begin to curb its asset purchasing program. Additionally, the Fed’s median forecast of when the Fed Funds rate will increase was bumped up to the end of 2022, with the Fed Funds rate projected to be 1.75% in 2024.

In Washington, politicians failed to get a deal done on infrastructure spending. I guess it is not a surprise, but it certainly did not help the market. At the same time, investors face the possibility that the US government with reach its debt ceiling, which is forecast on October 18th. Treasury Secretary Janet Yellen has warned of punishing consequences if the debt ceiling issues are not resolved. While I think it’s implausible that a breach will occur, it still is a variable that investors need to consider.

A missed debt payment by China’s most prominent land developed sent shockwaves through the market on concerns that the default could bring about a systemic failure to the global banking system. Markets sold off hard on the news but were able to bounce once Wall Street realized the international bank exposure was minimal outside China. Ironically the situation presents itself as Chinese regulators continued to crack down on specific market sectors and initiatives.

Technically, the market appears to be vulnerable. The S&P 500 breached its 50-day moving average and then had a nice bounce, but subsequently failed again at that level. The upcoming week will be critical to see if the index can regain that area of support or if it has now become an area of resistance.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

Monthly Market Review for August 2021

-Darren Leavitt, CFA

Global markets rallied in August as economic data revealed strength across the globe. However, delta variant infection rates soared during the month, especially in unvaccinated populations, which dampened sentiment and global growth expectations. The Senate passed a bipartisan infrastructure bill that would provide $550 billion in new spending in the US. The Bill was sent to the House, where it continues to be debated. The most recent Federal Reserve policy stance was provided at the Kansas City Fed’s annual Jackson Hole Economic Symposium. Investors were encouraged by a “balanced” speech given by Fed Chairman Jerome Powell. At the beginning of the month, emerging markets struggled as Chinese regulators continued crackdown on anti-competitive practices, privacy issues, and education sources and policy. The fall of the Afghanistan government to the Taliban cast doubt on US policy in the region and increased geopolitical uncertainty.

The S&P 500 gained 3.04% for the month, the Dow added 1.33%, the NASDAQ rose 4.04%, and the Russell 2000 was up 1.79%. Developed international markets gained 2.3%, Japan’s Topix rose 3.2%, and Emerging markets increased by 0.19%. The US Treasury market was all over the place in August. The 10-year yield touched 1.12% but closed the month at 1.29%, up five basis points. The 2-year yield increased two basis points to close at 0.2%. Gold prices were little changed, falling $5.10 to 1812.10 an Oz. Oil prices struggled, losing 6% or $4.66 to close at $69.21 a barrel.

A strong July employment situation report- 943k non-farm payrolls added, induced calls for the Federal Reserve to taper its asset purchase program. PMI data continued to show that the manufacturing and services sectors are in expansion mode. Consumer prices continued to rise, demonstrated by a 5.4% year-over-year increase in the CPI.

Leading up to the Fed’s meeting at Jackson Hole and given the robust economic data, many Fed Governor’s expressed that the Fed should start its taper sooner rather than later. However, J Powell struck a neutral tone and calmed markets. The Chairman acknowledged that the Fed had made substantial progress on its inflation mandate but still needed to make more progress on its employment mandate. The Chairman indicated that it was likely that the Fed would start to taper at the end of the year. Still, he ensured investors knew that there would not be changes to the policy rate for the foreseeable future and that financial conditions would remain accommodative.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

July 2021 Market Review and Outlook

Monthly Market Review for July 2021

-Darren Leavitt, CFA

US equity markets forged new all-time highs in July despite fears of a slowdown in global economic growth due to the delta variant of Covid. A bipartisan infrastructure bill made its way through the House and into the Senate for debate in Washington. The Federal Reserve spent the month of July walking a policy tight rope and curtailing June’s hawkish tone. The US Treasury yield curve flattened dramatically, which further fostered the peak growth narrative while at the same time highlighting the current structural issues within the US Treasury market. Second-quarter earnings announcements were much better than expected and helped to aid the equity market’s ascent. Economic data continued to be mixed but was headlined by changes in the labor market and increases in inflation metrics.

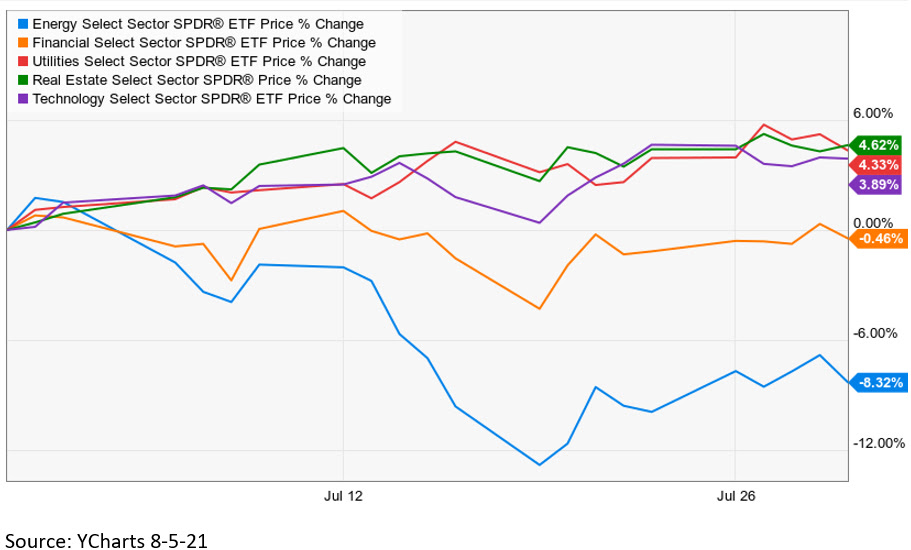

The S&P 500 gained 1.74% for the month, the Dow added 0.87%, the NASDAQ increased 1.03%, and the Russell 2000 lost 4.43%. Defensive sectors led in July with solid showings from Healthcare, Real Estate, and Utilities. Laggards included the Energy sector, which lost 8.82%, and Financials which lost 0.46%. International Developed markets increased 0.53% while Emerging markets were hammered, losing 5.91% due to increased regulatory scrutiny in China and lowered growth expectations related to low Covid vaccination rates in those geographies. The US yield curve flattened over the month as shorter-dated Treasury yields fell less than longer-dated yields. The 2-year note yield fell seven basis points to 0.18%, while the 10-year bond yield shed twenty-one basis points to close the month at 1.24%, the lowest yield since February. Fear that the Fed would make a policy error given the hawkish tone from the June meeting catalyzed the bid into US Treasuries. Additionally, the Fed’s asset purchase program of 120 billion a month coupled with strong domestic and foreign institutional demand kept US Treasuries well bid. This strong demand came when the US Treasury decided to issue less debt, which helped push short-sellers into the market. Gold prices increased by $46.80 to close at $1817.20 an Oz. Oil prices rose fractionally, gaining $0.34 to close at $73.87 a barrel.

At the end of the month, a bipartisan infrastructure bill looked likely to pass the Senate. The bill will add $550 billion in spending to an existing pool of $450 billion, and over eight years could be as big as $1.2 trillion. The plan includes spending initiatives on Roads and Highways, Airports and Ports, Public Transit, Railway infrastructure, Water infrastructure, and Clean waste projects.

Second-quarter earnings announced throughout the month were much better than expected. According to Factset, earnings per share and revenues topped analysts’ expectations 88% or the time. Furthermore, earnings per share were 17.2% higher than expected. However, despite the better than anticipated results, market action post announcements were mixed.

The June Employment Situation Report showed robust job creation with a Non-farm payroll figure of 850K. The July estimate calls for 925k jobs to be created. The Unemployment rate ticked higher in June to 5.9% and is expected to decline to 5.7% in July. The Labor Participation rate continues to be disappointing at 61.3%. Initial Claims and Continuing Claims were better in the front half of the month but regressed in the last two weeks. The Consumer Price index increased 0.9% on a month-over-month basis versus expectations for an increase of 0.7%. The Core CPI, which excludes food and energy, was also higher than expected, coming in at 0.9% versus expectations of 0.6%. At the producer level, the PCE came in a bit lighter than expected at 0.5%, as did the Core number at 0.4%. Retail Sales announced were much better than expected at 0.6% versus a loss of 0.4%. University of Michigan’s Consumer Confidence ticked higher to 81.2 from June’s reading of 80.8. Finally, the Advance Estimate for Q2 GDP fell light of expectations at 6.5%; the street had been looking for 8.2% growth.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

June 2021 Market Review and Outlook

Monthly Market Recap – June 2021

-Darren Leavitt, CFA

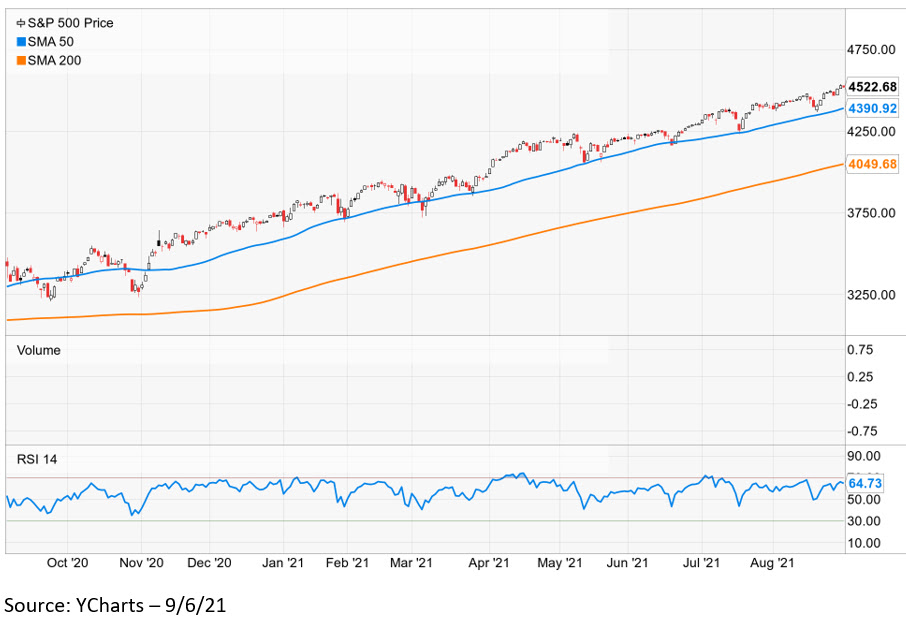

US financial markets were able to rally to new records in June despite a more hawkish Federal Reserve and rhetoric that suggested the US economy had seen peak growth and peak inflation expectations. A flattening yield curve over the month helped growth issues outpace value-oriented cyclical issues. The financial sector was bid higher late in the month on better than expected stress test results which induced bank CEOs to boost their dividends and stock buy-back programs. In Washington, a Bipartisan plan of infrastructure spending was laid out to the tune of 1.2 trillion dollars of spending, of which 579 billion will be new funds. Economic data was mixed over the month, but there did appear to be an improvement in the labor market.

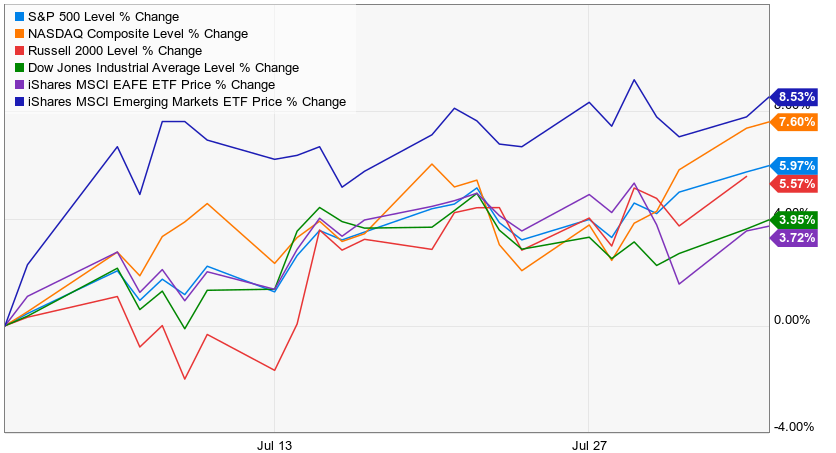

Source: YCharts – 7/5/2021

The S&P 500 tacked on 2.27% for the month, the Dow fell 0.21%, the NASDAQ climbed 5.59%, and the Russell 2000 gained 0.69%. A profound flattening of the yield curve saw shorter-dated maturities yield’s increase and longer-dated maturities yield’s fall. The 2-year note yield increased nine basis points to close at 0.25%. The 10-year bond yield fell fourteen basis points to close at 1.59%. When yields rise, bond prices fall, so the shorter end of the curve underperformed over the month. Gold prices fell $115.8 or 6% in June to close at 1786.40 an Oz. Oil prices continued to surge, gaining 13% on the month to close at 74.92 a barrel. Developed and emerging international markets struggled over the month due to renewed concerns that further lockdown measures may be needed as a new variant of Covid-19 materialized. Developed international markets lost 2.76%, while Emerging markets gave up 1.52%.

A more hawkish Federal reserve took investors by surprise in June. The Fed did not change its policy rate at the June meeting or change its asset purchase program. However, expectations for the future path of the policy rate did change, and the Fed’s dot plot suggested that there could be as many as two rate hikes starting in 2023. Additionally, 7 Fed Presidents conveyed their desire to raise rates in 2022. Later in the month, Fed Chairman Jerome Powell reiterated that there would not be any move in rates until necessary and said the Fed would telegraph the timing of its QE taper.

Economic data related to inflation came in a bit hotter than expected in June. However, investors seemed to dismiss the higher numbers and suggested that the higher readings were due to transitory factors. The Consumer Price Index was up 0.6% on a month-over-month basis or 5.8% on an annualized basis. Producer prices also increased in May. The PPI was up 0.8% on a month-over-month basis. Retail sales fell more than expected, falling 1.3% versus the expectation of -0.6%. Higher input prices curbed new Home Sales while existing home sales came in better than expected. Sentiment indicators such as Consumer Confidence and Consumer Sentiment continued to be strong in June.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

May 2021 Market Review and Outlook

-Darren Leavitt, CFA

Financial Markets ended the month of May with mixed results. A prominent rotational trade was again present throughout the month. Inflation was top of mind and debated by investors as some economic data fueled concerns of a systemic increase in goods and services prices. In Washington, politicians continued to discuss the inputs and size of an infrastructure spending plan while the Federal Reserve maintained its current monetary policy stance. First-quarter earnings season finished with stellar results but mixed price action. Cryptocurrencies were extremely volatile and settled at levels well below their most recent highs by month-end.

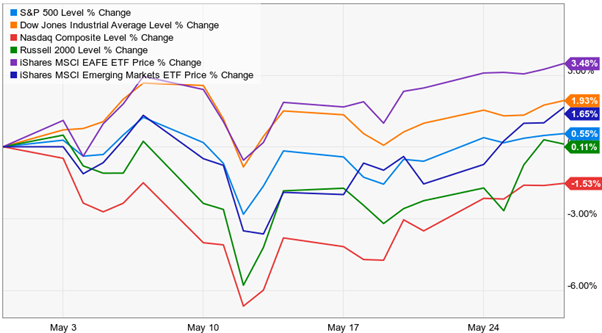

The S&P 500 gained 0.55% for the month, the Dow was higher by 1.93%, the NASDAQ fell 1.53%, and the Russell 2000 inched out a 0.11% increase. Developed international markets increased by 3.48%, while emerging markets gained 1.65%. Despite all the worries about inflation, the US Treasury yield curve flattened. The 2-year note yield fell two basis points to 0.14%, and the 10-year bond yield dropped five basis points to 1.58%. Interestingly, gold often thought of as a hedge against inflation, increased 7.5% or $134.30 to close at $1902.20 an Oz. Oil prices continued to rise, gaining 4.5% or $2.81 to close at $66.32 a barrel.

The global vaccination efforts continued in May, and we continued to see significant shots being put into the arms of Americans and Europeans. India continued to struggle with its efforts and saw infection rates and deaths soar but did see substantial progress towards the end of the month.

The closure of the global economy has disrupted some supply chains, and we are starting to see the ramifications of these disruptions. Inflation measures such as the CPI, the PCE Price Index, and inflation expectations in sentiment indicators all ticked higher in May. Used Cars, Rental Cars, Airfares, and Hotel room prices led these price data sets higher. The debate on whether these price increases are systemic or transitory was a considerable influence on the markets in May. If you believe what the Federal Reserve told us at their May meeting and the action seen in US Treasury bonds, it currently appears transitory. If you look at prices in the commodity complex such as Gold, Oil, and industrial metals, perhaps it seems a little stickier. Wages are a significant variable in the inflation equation, but the labor data in May was blurry. For instance, the April Employment Situation report showed just 266k non-farm payrolls created; expectations were for 1 million jobs to be made. We also saw the Unemployment rate tick higher to 6.2%. On the other hand, we saw Initial Claims and Continuing Claims trend lower. The tepid increase in jobs has some calling for the end of the enhanced unemployment benefits, which some argue keep perfectly able workers from going back to the workforce. Wall Street will continue to ascertain inflation, and it will certainly significantly influence the markets in the coming months.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.

March 2021 Market Review and Outlook

-Darren Leavitt, CFA

A prominent rotational trade out of mega-cap growth stocks into value-oriented cyclical issues extended US equity indices gains in March. Covid-19 inoculations continued to ramp up in the US as broader segments of the population became eligible to receive the vaccine. It was a different story in the EU block where vaccination rates have lagged, and infighting over the distribution of vaccine supplies has strained political ties. Robust economic data coupled with the passing of the 1.9 trillion dollar stimulus bill and rhetoric regarding a 2.3 trillion dollar infrastructure spending plan strengthened inflation concerns and induced a significant sell-off in longer-dated US Treasuries. Corporate headlines throughout the month also confirmed the pick-up in economic activity.

For the month, the S&P 500 gained 4.24%, the Dow tacked on 6.62%, the tech-heavy NASDAQ added 0.41%, and the Russell 2000 inched higher by 0.88%. The US Treasury curve steepened significantly over the month, which has all kinds of ramifications for investors to consider. The 2-year note yield increased two basis points to 0.16%, while the 10-year note yield increased twenty-nine basis points to close at 1.75. The 10-year yield rose 85 basis points in the first quarter, the largest quarterly move since 1980. Oil prices were little changed for the month. WTI lost just over 3% or $2.35 to close at $59.19. OPEC did increase its output mandate from May to July to accommodate higher demand. Gold prices fell $13.20 to close at $1715.20 an Oz.

Investors experienced similar market action in March as we did in February. The US economy appears to be emerging out of a Covid coma, and with it, investors are rotating into economically sensitive sectors of the market that have lower valuations. Energy, Financials, Materials, and Industrials have come into favor as mega-cap tech names have taken a back seat. Small caps, which are generally more influenced by the domestic economy, have also done quite well. This comes as more vaccine shots are going into American arms, and vaccination protocols have broadened to include most of the population. The increase in vaccination rates was needed to reopen the economy. Travel data is up, lockdown measures have been reduced or eliminated, kids are back in school, and people just want to get out and get on with their lives. This comes as personal savings rates are high and another set of stimulus checks has hit bank accounts- money to spend on restaurants, bars, concerts, movies, and traveling. The resurgence of demand is likely to affect the price of goods and services. We are currently seeing prices increase at the producer level. That increase is likely to be passed on to the consumer- all of this is inflationary and has been one reason we have seen longer-dated interest rates rise over the last few months. Some economists believe that the possible increase in prices will be transitory and that after a few quarters, it will subside as supply catches up with demand. As I mentioned, higher rates have enormous ramifications for asset prices and could lead to certain asset classes selling off. Higher valuation equities are more susceptible to higher rates hence the rotation we have seen of late.

One just needs to point to the last two Employment Situation Reports to see the labor market’s progress. The February reading showed 379k non-farm payrolls created and the unemployment rate falling from 6.3% to 6.2%. The March reading showed that 916k non-farm payrolls had been created and that the unemployment rate had dropped to 6%. Similarly, we have seen better than expected PMI data on both the Manufacturing and Services fronts. It is not a surprise to see sentiment indicators also ticking up. The most recent Consumer Confidence indicator came in at 109.7, well above the 97 consensus estimate.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.

January 2021 Market Review and Outlook

-Darren Leavitt, CFA

Financial markets started 2021 in strong form but lost some ground in the final week of trade. Covid-19 vaccines continued to be developed, and inoculations continued to be administered to front line workers and the elderly. A light at the end of the tunnel helped stabilize sentiment even as specific geographies imposed further coronavirus lockdown measures. A Democratic sweep in the Georgia Senate seat run-off election gave the Democrats a slim majority in Congress and increased another fiscal stimulus tranche’s likelihood. The win also opened the door for President Biden’s green initiatives, which bolstered electrical vehicle issues and other alternative energy companies. Economic data continued to be mixed, and the January Federal Reserve meeting was as expected.

For the month, the S&P 500 lost 1.11%, the Dow fell 2.04%, the NASDAQ gained 1.42%, and the Russell 2000 outperformed with a return of 5%. Emerging Markets gained 3.17%, and Developed international markets fell 0.78%. The US Treasury curve steepened as the 10-year bond yield traded above 1%. The 2-year note yield decreased one basis point to 0.11%, while the Ten-year bond yield closed the month up fifteen basis points to 1.09%. Gold prices fell $43.20 or 2% to close at $1850.50. Oil prices continued to climb, closing up 8% or $3.91 to $52.18 a barrel.

Investor’s risk appetite continued into the New Year as vaccinations were put into more arms and on hopes that more stimulus would be coming down the pipe. Logistics around inoculations were criticized throughout the month with efforts not living up to what had been promised. Shortages of vaccines and the lack of proper healthcare workers/facilities available and in place were reported on often. Despite the hang-ups, the rate of infections across the globe slowed later in the month. The slower pace of infections was most likely due to the additional lockdown measures that continued to hinder the global workforce.

Here in the US, job creation in January was slow but a bit better than the negative Non-farm payroll number seen in December. The weak data from initial claims and continuing claims for some validate calls for more stimulus. The Georgia Senate run-off race provides a slim Democratic majority in Congress that increases the likelihood of more stimulus. The Biden administration has outlined another 1.9 trillion dollars “American Rescue Plan” that will put another $1400 in direct payments to US households. The Federal Reserve’s January meeting was as expected. The Fed left the Fed Funds rate unchanged at 0-.025%. Fed Chairman Powell continued to call on Congress for more fiscal stimulus and commented that recent strong market action was likely due to positive vaccination developments and on the notion that more fiscal stimulus was coming.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.

December 2020 Market Review and Outlook

-Darren Leavitt, CFA

Financial markets rallied in December on the prospects and ultimate agreement of another tranche of Coronavirus stimulus. Covid-19 vaccine emergency use approvals from the FDA aided market sentiment even as daily infection rates, hospitalizations, and deaths hit highs. Economic data continued to be mixed but showed continued progress on the employment front. December also ushered in another round of equity IPOs that were well received by Wall Street. The UK and EU also finally announced that they had come to a post-Brexit trade agreement, which prompted European issues higher.

December saw a broad rally in the market with growth, value, cyclical, and small-caps issues showing excellent returns. The S&P 500 gained 3.71%, the Dow increased by 3.27%, the NASDAQ added 5.65%, and the Russell 2000 led gainers with a return of 8.52%. The US yield curve steepened over the month as longer-dated Treasury yields increased relative to shorter maturities. The 2-year note yield fell two basis points to 0.12%, while the 10-year bond yield rose by eight basis points to close at 0.94%. Gold prices increased by $112.4 or 6.3% to close at $1893.70. Interestingly, Bitcoin, which has recently been seen as another proxy to hedge against inflation and a weak dollar, surpassed 30k. Oil prices rallied over 6%, gaining $2.81 to close at $48.27 a barrel. Emerging markets gained 4.92% for the month while developed international markets rose 2.59%.

Throughout most of the month, investors watched Washington negotiations on another coronavirus relief bill. Ultimately, a bill tied to the government’s continued funding was agreed to and signed by the President. The final package includes $600 in direct payments to households, $300 in extended unemployment benefits, and aid for specific industries such as the airlines. The bill also saw an end to many lending facilities created under the Cares Act, and $429 billion in unused Cares Act funds were returned to the Treasury.

Covid-19 infection rates continued to soar over the month even as state and local officials announced further lockdown measures. Officials also announced that a new strain of the virus had been discovered. The new strain appears to spread much more quickly but does not appear to increase sickness or death. Over the month, a light at the end of the tunnel appeared as the FDA and its global counterparts announced emergency use authorization of a few vaccines. Inoculations started mid-month with front line healthcare workers and the elderly receiving the vaccine first.

The month started with a disappointing November Employment Situation report that showed tepid payroll generation. Throughout most of the month, Initial unemployment claims came in higher than expected, most likely due to the increased lockdown measures. That said, Continuing Unemployment claims trended lower and hit the lowest level since March in its most recent reading. The December Federal Reserve Open Market Committee meeting was as expected. The Fed left the Fed funds rate at 0-0.25% and said they would continue to purchase 120 billion US Treasuries and Municipals per month.

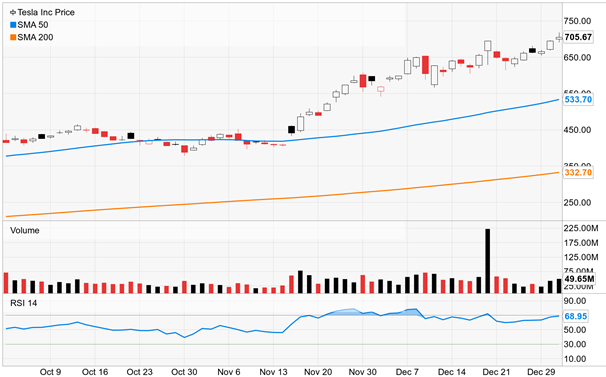

The IPO market continued to sizzle in December. Headliner, Airbnb, priced at $68 a share but opened to public trade at $146 and closed up 112% on the first day of trading. Similar action was seen in Door Dash and AI C3. This market action may give some reason for concern as some start to point to the lofty valuations within the market that now trades 22x forward earnings relative to the historical average of 15x. The electrical vehicle space was also scorching during the month catalyzed by Tesla’s inclusion to the S&P 500. Tesla’s market capitalization is now more than the seven other largest automakers combined.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.

November 2020 Market Review and Outlook

-Darren Leavitt, CFA

Global markets rallied in November. A historic US election played out as one of Wall Street’s best-case scenarios. Three effective Covid-19 vaccines were announced over the month, which further stocked investor enthusiasm. Third-quarter earnings season continued to show better than expected results, and economic data showed some progress on the labor front.

Value-oriented equity issues along with small-caps and cyclical sectors led the gains in November. Value equities were up 15.1%, Small-caps gained 15.4%, and the energy sector ripped over 30% higher. The S&P 500 increased by 10.75%, the Dow rose 11.5%, the NASDAQ tacked on 11.8%, and the small/midcap focused Russell 2000 increased an impressive 18.29%. International developed and emerging markets also posted nice gains of 12.8% and 9.3%, respectively.

The US Treasury curve was little changed for the month. The 2-year note yield lost one basis point to close at 0.14%. The 10-year bond yield decreased by two basis points, closing at 0.84%. Global investment-grade bonds gained 3.1% for the month while US high yield returned 4%. Emerging market bonds increased a respectable 3.7%.

Gold prices fell throughout the month, posting a $127.30 or 6.6% decline to close at 1908.60. The risk-on appetite, coupled with the notion that Bitcoin could be taking market share away from gold as a hedge against inflation, most likely dampened demand for the commodity over the month. Interestingly, Bitcoin rallied sharply over the month and closed above $19,000. Oil prices were materially higher over the month on renewed hopes for the global economy. WTI increased by 27% or $9.67 to close at $45.37 a barrel. Of note, OPEC is meeting in the first week of December to calibrate production plans. As usual, there appears to be a meaningful amount of dissent in what the appropriate production levels should be, and Oil could likely trade lower on an impasse.

The US election in 2020 was indeed historical, with a record number of Americans getting out to vote. Despite numerous legal efforts by President Trump’s camp, it appears certain that Joe Biden will be the next President of the United States. In the lower house of Congress, Republicans picked up seats, but the Democrats retained the majority. The Senate will likely remain in the control of Republicans, but a runoff of 2 Senate seats in Georgia has the possibility to alter that outcome. Wall Street embraced the results. A divided congress likely means no change to the tax code and that the Senate will continue to temper democrat’ fiscal spending policies. That said, a Biden administration is likely to extend an olive branch to many global leaders and try to mend some of the diplomatic ties that have been strained. Additionally, Biden will likely rejoin the Paris Accord to combat global warming and, in turn, implement several environmental policies and initiatives.

Over the month, three Covid-19 vaccines were reported to have shown promising results. Pfizer’s and BioNTech’s candidate was the first to be showcased with an efficacy of 90%. The FDA will meet with the companies on December 10 to go over the results and decide on emergency use approval. The vaccine is similar to Moderna’s candidate in that it needs to be stored at very low temperatures, which adds another variable to logistics. Moderna’s vaccine showed 94% efficacy, and the company is scheduled to be in front of the FDA on December 14t. Finally, the Astra Zeneca/Oxford vaccine had solid results showing 70% efficacy in one cohort and 90% in another. The company apparently had some problems with manufacturing that altered the dosing in the trial. None the less it is also earmarked for review in front of the FDA in the coming weeks. The news of the vaccine is precisely what the market needed, and investors applauded human ingenuity. It provides a “light at the end of the tunnel.” No doubt that there are still numerous logistical hurdles to get over before we get the virus under control. Currently, the rate of infection is increasing materially in several geographies. Europe has imposed national lockdown mandates after local mandates failed. The lockdowns are dampening economic activity but seem to be curbing the infection rate. In the US, spikes in infections have caused numerous states to impose new lockdown measures. Thanksgiving travel was 40% of what it was last year, yet 6 million passengers passed through airports despite warnings from the CDC and NIH. Again, further lockdown initiatives are likely to hinder economic activity in the near term, but markets are forward-looking and hopeful the upcoming inoculations will win the day.

Third-quarter earnings continued to impress in November. According to Factset, S&P 500 earnings would have been positive if three sectors were removed. Energy, Airlines, and the Hotel and Leisure sectors caused the drag. Interestingly, all three sectors did quite well in November. Economic data continued to be mixed. Manufacturing and Services data were better than expected. Housing continued to be a source of strength, with existing home sales, building permits, and housing starts all showing better than expected results. The first two weeks of high frequency data on initial claims and continuing claims painted a better picture only to regress in the final two weeks. The October reading of the unemployment rate fell to 6.9%, which was also encouraging. Sentiment data fell as consumer sentiment, and consumer confidence declined from prior levels, most likely due to the spike in coronavirus infections and the prospects for further lockdowns.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.

October 2020 Market Review and Outlook

-Darren Leavitt, CFA

Global financial markets had mixed performances in October. Investors were hoping for another tranche of stimulus from Washington, but the politicians were too far apart to get a deal done in the end. The US Presidential election continued to loom, and the numerous uncertain outcomes in the election provided a reason to reduce risk in some model portfolios. Increased infection rates across the globe, mainly in Europe, dampened economic recovery expectations. Progress on a Covid-19 vaccine was encouraging but not without some setbacks. 3rd quarter earnings also rolled in with varied results, which resulted in some very dramatic individual stock moves.

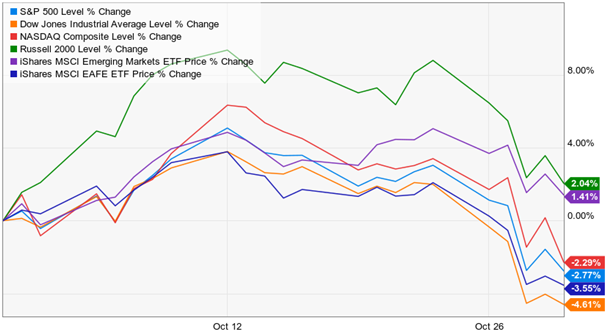

For the month, the S&P 500 lost 2.77%, the Dow Jones Industrial Average shed 4.61%, the NASDAQ fell 2.29%, and the Small Cap Russell 2000 bucked the trend gaining 2.04%. Developed European markets ex the UK lost 5.4% in October while emerging markets gained 2.1%. The US Treasury curve steepened during the month. The 2-year note yield increased two basis points to 0.15%, while the 10-year bond yield rose by eighteen basis points to 0.86%. Investment-grade credit was little changed. Interestingly, German 10-year Bund yields fell ten basis points to close at -0.63%. Gold traded fractionally higher, gaining $12.90 to close at 1908.60 an Oz. Oil suffered on the prospects of a slower economic recovery losing 11% on the month of $4.51 to close at 35.70 a barrel.

Uncertainty about the upcoming election, along with contentious negotiations on another tranche of stimulus, was top of mind for US investors throughout October. Election polls had Biden in the lead for most of the month but with a lead less than the tracking error. Wall Street strategists penned notes handicapping what each political outcome could mean for the markets but often provided differing opinions. In front of the election, political posturing had both sides saying they were willing to negotiate a new fiscal stimulus plan. Still, the two sides were too far apart and unwilling to give up something that could upset their constituents. It is clear that the economy needs another round of stimulus, and it will likely get another dose; however, the timing of a deal is anyone’s guess.

Corona Virus infections increased over the month and topped 90k per day in the US. In Europe, locally oriented lockdown measures have been replaced by national lockdown mandates. Italy, Spain, Germany, France, and the UK have all implemented these new measures, putting pressure on European markets. A path to a Covid-19 vaccine has made material progress with many trials in late stages. However, the progress does come with some setbacks. Several trials were postponed for different reasons, but some of these trials have been restarted. The process will continue to be two steps forward one step back until we have a successful vaccine. Elsewhere the treatment of the virus has become much better over time, and the use of Gilead’s Remdesvir received FDA approval. Similarly, we saw Regenoron’s antibody cocktail show promising results in fighting the virus.

3rd quarter earnings continue to come in. With just over 64% of the S&P 500 companies having reported, Factset reports that 86% of those have reported better than expected earnings per share, and 81% have reported better revenues. At the beginning of the month, companies were rewarded for their better than expected results, but it was quite the opposite in the final week of the month. Mega-cap technology companies such as Apple, Facebook, and Amazon reported solid numbers last week only to see their share prices lower after the announcement. Perhaps the results had already been reflected in the price gains seen earlier in the month. All in, not a bad earning season.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.

August 2020 Market Review and Outlook

-Darren Leavitt, CFA

Global equity markets continued their ascent in August. Developed international markets increased by 4.72%, while emerging markets increased by 2.89%. The S&P rose 7.01%, the Dow gained 7.57%, the tech-heavy NASDAQ led gains with a 9.59% return, and the Russell 2000 inked a 5.5% gain. The US yield curve steepened a bit with the 10-year bond yield increasing by 15 basis points to close at 0.69% while the 2-year note yield rose three basis points to close at 0.13%. The sell-off in Treasuries came as the Federal Reserve modified their policy on inflation; the revision would allow inflation to run higher at times to average out the most recent times when inflation has been well below their mandate. Oil gained ~6% over the month, rising $2.50 to close at $42.62 a barrel. The advance in gold seen early in the summer paused as the precious metal price was little changed, losing $8.1 to close at 1978.40 an Oz.

Coronavirus infection rates subsided in the US from measures taken in July to temper its spread. Novel treatment of the virus coupled with advances in testing and a vaccine provided a positive backdrop for investor sentiment. The FDA approved the emergency use of convalescent plasma as numerous tests showed efficacy in its use as a treatment in severe COVID cases. The FDA also approved Abbot Labs’ 15-minute antigen test to add to our current testing options. Many companies continued to advance their vaccine trials, and many have shown the ability to induce an immune response. Moderna, Pfizer, and AstraZeneca are a few of the companies pursuing vaccine solutions.

On the political front, Joe Biden and Kamala Harris accepted their party’s nomination for President and Vice President. Donald Trump was also named the Republican nominee. The DNC and RNC did not cause any catalysts for the market and were seen as expected. In Washington, the administration and Congress continued to be far apart on another round of COVID-19 relief stimulus. At the heart of the relief, the package is the supplemental unemployment insurance. At the end of July, the $600 additional insurance was halted, and the unemployed now are receiving their respective state insurance. This is a meaningful amount of money given continuing unemployment claims were more than 14 million throughout August. With the Presidential election a couple of months away, it is hard to see that either side will budge, although there have been some recent overtones on breaking the stalemate.

Second-quarter earnings continued to come in better than expected in August. The above-consensus earnings results and revenue results definitely helped equity markets. It was most apparent in the technology sector, where companies just blew away the street’s expectation. Apple always stands out, and its results for the quarter pushed the company’s market capitalization through 2-trillion. Elsewhere, healthcare continued to well given the need for testing, PPE, and a vaccine developed. Energy and Real Estate lagged during the month.

On the economic front, things appeared to be getting a bit better. The assessment of economic data is, however, a challenge right now, and some of the data will continue to be distorted, given the severe shut down of the economy since early March. That said, we continued to see progress on the employment front where continuing claims continued to come down, and initial claims look to have peaked out. Manufacturing and services data continued to show expansion in August. The housing market has been a real source of strength as existing home sales, and new home sales set records.